-

SEE 42-in RE Cruz vs Aurora AURORA LOAN SERVICES LLC, SCME MORTGAGE BANKERS INC, ING BANK FSB, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS ALL BITE THE DUST, SUBJECT TO LIABILITY AND NO ABILITY TO FORECLOSE WITHOUT COMPLYING WITH LAW. Salient points of Judge Mann’s Decision: TRUTH IN LENDING was dismissed because they were time-barred. LESSON: Don’t ignore […]

-

timothymccandless.wordpress.com recallcitycouncil.wordpress.com chapter11bankruptcy.wordpress.com fairdebtcollectionpracticesact.wordpress.com marionmccandless.wordpress.com trustdeedinvestment.wordpress.com rocketrecoverysystem.wordpress.com mortgagereductionlaw.wordpress.com mortgageregistationsystems.wordpress.com massjoinderlitigation.wordpress.com financialelderabuse.wordpress.com landlordfraud.wordpress.com http://mybk7.com http://mortgagereductionlaw.com http://evictiondefender.com…

-

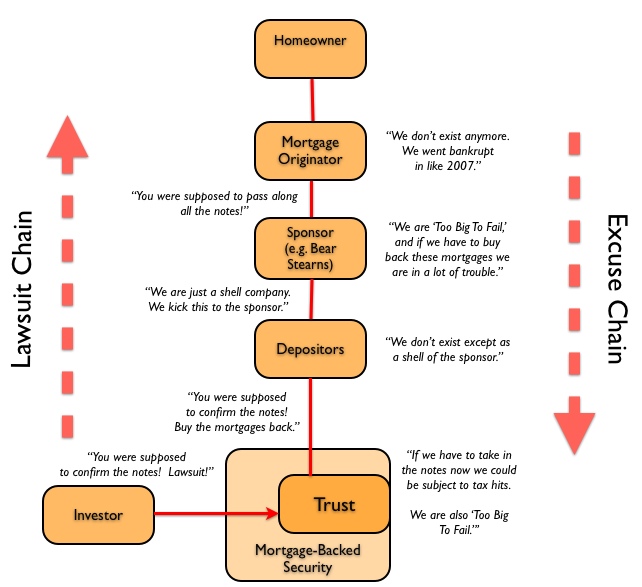

Posted on August 7, 2011 by Neil Garfield EDITOR’S NOTE: We know the foreclosures were gross misrepresentations of fact to the Courts, to the Borrowers and to the Investors. This article shows the crossover between the MegaBanks — sharing and diluting the responsibility for these fabrications as they went along. If you are talking about […]

-

I looked into the records for that entity in the SEC EDGAR online database and discovered that the last annual report was filed in 2007, contemporaneously with a FORM 15 filing.That Form 15 filing claimed a standing under 15d-6 of the 1934 SEC regulations which exempts the entity of filing an annual report, whereby the […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE Submitted on 2011/08/24 at 9:08 pm Norwest and Alt-A Land Title & Fidelity National Insurance morpted into Microsoft open platform on CLOUD and portals now through which new GMAC Mortgage & State of Maryland in the pass-thru-agency state portal funded to access FIS, […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE EDITOR’S NOTE: It is comforting to know that at least some people are paying attention. From one of the largest servicers in the country comes an admission that securitization of mortgage loans was an illusion. The facts alleged by AHMSI in its lawsuit […]

-

Finality versus good and evil. In the battlefield it isn’t about good and evil. It is about winner and losers. In military battles around the world many battles have been one by the worst tyrants imaginable. Just because you are right, just because the banks did bad things, just because they have no right to […]

-

“If you’re allowed to foreclose and kick someone out of his or her home without being the party that either owns the loan or represents the person who owns the loan… if you can ignore those laws, why can’t you ignore other laws too? Which laws apply, when one of the parties didn’t make his […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE see VIDEO $1.2 Trillion in EXTRA BAILOUT MONEY FROM FED SECRETLY GIVEN TO DOMESTIC AND FOREIGN BANKS Of course the figure is much higher, but the secrecy surrounding the money given by the Fed to the banks is something to enrage any tea […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE EDITOR’S NOTE: Here is a good place to start — the devil is in the details. You will find that the more you probe the more people and bad documents emerge. Persistence pays. Here is a letter that one homeowner just sent to […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE The boys are playing rough now, but US Bank, failing to take its queues from Deutsch is plunging ahead with CalWestern by its side, using forged, fabircated, faked documents that wouldn’t be valid even if they were properly executed. The securitizers tricked and […]

-

SAN FRANCISCO — Attorney General Kamala D. Harris today announced that the California Department of Justice, in conjunction with the State Bar of California, has sued multiple entities accused of fraudulently taking millions of dollars from thousands of homeowners who were led to believe they would receive relief on their mortgages. Attorney General Harris sued […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE IF THE BANKS DON’T OWN THE PROPERTY OR THE MORTGAGE, WHO DOES? EDITOR’S NOTE: My figures tracking thousands of foreclosures indicate the same thing that the New York Post found. There are a scattered few foreclosures that are good old-fashioned foreclosures of valid […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE EDITOR’S COMMENT: I was talking with an expert in landlord tenant law and I received an interesting suggestion. The case involved someone who has just been served with a writ of restitution where the owner had to peaceably leave her home — or […]

-

Wednesday, August 17th, 2011, 2:49 pm A controversial case challenging the ability of Mortgage Electronic Registration Systems to foreclose on a California man was filed with the Supreme Court Monday, making it the first major MERS case to reach the nation’s highest court. If the Supreme Court agrees to hear Gomes v. Countrywide, Gomes’ attorney, […]

-

by KERRI PANCHUK Proposed Illinois Legislation Would Freeze Evictions for Four Months California AG Wants Pay Option ARM Answers Does the Senate’s housing bill encourage foreclosures? California Law Freezes Foreclosures, Burns Servicers Short Sales Cost Lenders $310m More Than Necessary, CoreLogic Study Finds Thursday, August 4th, 2011, 7:31 am A California man is on a […]

-

So you have denied the claims of the pretenders and put that in issue. You have even alleged fraud, forgery and fabrication and the catch-word “robosigning”. But the Judge, alleging that he did not want to “make new law” (which wasn’t true) or allegedly because he didn’t want to start an avalanche of litigation interfering […]

-

Contact Us: MortgageReductionLaw.com Dear Homeowner, It’s been widely reported around the country, via internet, blogs and newspapers, how the lenders used the foreclosure mills and other legal ways, to fabricate fraudulent documents to record in the county recorder offices and pretend they have legal standing to initiate the foreclosure procedure. Neil Garfield in his blog […]

-

TIMOTHY L. MCCANDLESS, ESQ. SBN 147715 LAW OFFICES OF TIMOTHY L. MCCANDLESS 820 Main Street, Ste. 1 Martinez, CA (925) 957-9797 Telephone (909) 382-9956 Facsimile Attorney for Defendant Zenkarla S. Salazar SUPERIOR COURT OF THE STATE OF CALIFORNIA IN AND FOR THE COUNTY OF SANTA CLARA GMAC MORTGAGE, LLC FKA GMAC MORTGAGE CORPORATION, Plaintiff, vs. […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE EDITOR’S NOTE: We know the foreclosures were gross misrepresentations of fact to the Courts, to the Borrowers and to the Investors. This article shows the crossover between the MegaBanks — sharing and diluting the responsibility for these fabrications as they went along. If […]

-

posted by Katie Porter As challenges to whether a “bank” (usually actually a securitized trust) has the right to foreclose because it owns the note and mortgage become more common, rumors swirl about the ability to use such tactics to get a “free house.” There are a few instances of consumer getting a free house, […]

-

From LivingLies: I think that everyone is missing the #1 problem MERS has in CA. MERS is a Non-Authorized Agent and cannot legally assign the Promissory Note, making any foreclosure by other than the original lender wrongful, for the following reasons. 1) Under established and binding Ca law, a Nominee can’t assign the Note. Born […]

-

Posted on August 1, 2011 by Neil Garfield I WRITE THIS BECAUSE WITH SO MANY PRO SE LITIGANTS AND UNINFORMED LAWYERS WEIGHING IN IT IS SOMETIMES NECESSARY TO CLARIFY THE ISSUES. Quiet Title is not a defense. If used defensively you will most likely lose your case and also unintentionally waive rights that you might […]

-

Pro Per Debtor Stops Attorneys for US Bank – in RE Deamicis Posted: 31 Jul 2011 10:21 PM PDT Pro Per Debtor Stops Attorneys for US Bank – in RE Deamicis By Daniel Edstrom DTC Systems, Inc. She has been fighting tooth and nail. Nobody was listening. The current bankruptcy judge was skeptical when she […]

-

Recent Consent Orders Consent Order, Sovereign Bank, Wyomissing, Pennsylvania, 04410, NE-11-17, April… Order shall be directed to the Comptroller of the Currency, or to the individual, … or office designated by the Comptroller of the Currency. Sovereign Bank Consent Order Page http://www.mortgagedaily.com/forms/OccConsentOrderSovereign041311.pdf Consent Order, OneWest Bank, FSB, Pasadena, California, 18129, WN-11-011,

-

A Bakersfield homeowner is taking on a bank, in a battle that could have sweeping implications for people facing foreclosure. Mark Demucha wants Wells Fargo to prove it owns his home loan. And, if his lawsuit is successful, it could set a legal precedent that slows or even stops foreclosures across the state. “Filled out the […]

-

17 News Investigation: Homeowner challenges bank. Filed under: Foreclosure, I Have a Plan, lis pendence, mers, Mortgage modification

-

Mark DeMucha v Wells Fargo Bank; Kutak Rock LLP; Homeowner Wins a California Appeal; Reversed and R http://www.scribd.com/doc/60748498/Mark-DeMucha-v-Wells-Fargo-Bank-Kutak-Rock-LLP-Loses-a-California-Appeal-Reversed-and-Remanded Added by PENDING LAWSUIT on July 24, 2011 at 9:30am — No Comments Barry Fagan v Wells Fargo re: KOSAR PETITION WHY ACTION SHOULD NOT BE DISMISSED, WITH PREJUDICE, FO…

-

One West Bank click to see full order from comptroller of the currency Filed under: I Have a Plan Tagged: one west

-

A. Standing The party seeking to invoke federal jurisdiction has the burden of establishing standing.28 Constitutional standing analysis includes three elements: (1) the plaintiff must have suffered an injury in fact—an invasion of a legally protected interest which is (a) concrete and particularized, and (b) actual or imminent, not conjectural or hypothetical; (2) there must […]

-

(1) Notaries Public § 1–Disciplinary Proceedings–Time for Instituting. Disciplinary action taken by the Secretary of State against a notary public was not barred by the fact that the proceeding was instituted more than three years after the notary’s alleged improper act and more than one year after its discovery. Statutes of limitation barring civil actions […]

-

SEPARATION OF DEED OF TRUST FROM NOTE: Bellistri Opinion Posted on April 28, 2010 by Neil Garfield There is a lot of conflicting opinions about this. My opinion is that the confusion arises not from the law, not from application of the law and not from what is written on the note or deed of Trust. […]

-

Brand New, Hot Off The Presses MERS Policy Bulletin July 24th, 2011 | Author: Matthew D. Weidner, Esq. After years of claiming that assignments don’t matter and the date of assignment certainly doesn’t matter, the MERS Monster has finally changed its tune, effective July 21, 2011: The Certifying Officer must execute the assignment of the […]

-

Stay of Execution and Appeal The defendant may request a stay of execution of the judgment whether or not an appeal is taken. [CCP §918(a), (c).] You may stay execution of the judgment for up to 40 days without the landlord’s consent in a limited civil case (or up to 70 days in an unlimited […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE factual issues for Unlawful Detainer case NFG 7-15-11 Various states have two levels of jurisdiction that make it difficult to raise the proper issues in eviction even if there has been no preceding judicial action or if the preceding judicial action has been […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE The Free House Myth posted by Katie Porter As challenges to whether a “bank” (usually actually a securitized trust) has the right to foreclose because it owns the note and mortgage become more common, rumors swirl about the ability to use such tactics […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE EDITOR’S NOTE: The battle is heating up. BOA, for example, is stepping up efforts to cause as much trouble as possible for those foreclosure defense lawyers who are getting traction in the courts. This started some time ago as some people were actually […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE No Punishment = Continued Misconduct Posted on July 19, 2011 by Mark Stopa Esq. http://www.stayinmyhome.com/blog/?p=1565 In Maine, a group of drug dealers was caught distributing drugs to local middle schoolers. They confessed, yet the District Attorney declined to press charges, so the drug […]

-

Recently Discovered Flaw in Recording System Clouds Titles on Previously Foreclosed Properties The modern system of mortgage refinancing and assignments created during the housing boom has left behind a wave of title defects on properties that have ever had a foreclosure in their history, due to a loophole in the property records recording system. […]

-

The brief below as circulated by the California Bar’s: Insolvency Law Committee: Herrera vs. Deutsche Bank National Trust Co., 2011 Westlaw 2547979 (Cal.App.) Facts: A married couple (“the homeowners”) purchased a home at a foreclosure sale. Supposedly, unbeknownst to them, their interest in the home was subject to a prior (and perhaps unrecorded) deed […]

-

If the court follows the rules of evidence (and they do) if proper objections are filed. No eviction of a secuitized loan should ever prevail on an eviction; they cannot produce the foundation to authenticate the Trustees Deed it is based upon preliminary facts that they are unable and unwilling to bring to court. The […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE EDITOR’S NOTE: Anyone who has entered into mortgage modification process with BOA or any other bank acting as servicer or otherwise knows the story. The Bank does everything it can to delay the process until the borrower gets into serious trouble and then […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE JUDGES ARE STARTING TO EXAMINE DOCUMENTS AND THEY DON’T LIKE WHAT THEY ARE SEEING “Thus, while A.R.S. §33-807(E) may operate to dismiss a trustee in certain instances, if one of the allegations of a complaint is that the entity purporting to act as […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE The Allonge- Billions of Dollars in Commerce Hangs on A Single Scrap of Paper EDITOR’S NOTE: If you wrote a check to your next door neighbor, you would expect that he would either cash it or deposit it. But what if your neighbor […]

-

All banks love to use judicial notice to establish their position but with all the robo signing the evidence is being excluded. ROBERT HERRERA et al., Plaintiffs and Appellants, v. DEUTSCHE 1 BANK NATIONAL TRUST COMPANY et al., Defendants and Respondents. No. C065630. Court of Appeals of California, Third District, El Dorado.Filed May 31, 2011. […]

-

False Statements 06/28/2011 California Bankruptcy Judge Laura Stuart Taylor has joined the ranks of judges who will not tolerate fraudulent documents produced by banks to foreclose. Judge Taylor entered an Order To Show Cause why OneWest Bank, FSB, should not incur “a significant coercive sanction intended to deter any future tender of misleading evidence to […]

-

From ChaseChase.org: Federal District Court Javaheri v. JPMorgan Chase, Case No. CV10-8185 ODW Otis D. Wright II, Judge, U.S. District Court, Central District of California, Los Angeles Douglas Gillies, attorney for Daryoush Javaheri Plaintiff sued to halt a foreclosure initiated by JPMorgan Chase and California Reconveyance Co. Chase responded with a Motion to Dismiss. Two […]

-

By Niel Garfield EDITOR’S NOTE AND COMMENT: LAWYERS BEWARE! Starting up an anti-foreclosure venture and making comments criticizing the system has reportedly caused some investigations to begin and may result in bar discipline for technical infractions. From what I can see, the Bar is focused on UPL — unauthorized practice of law. The use of […]

-

Each day I get calls from desperate people hoping against hope the there is a magic document that can be filed or recorded the will magically give them their home free and clear without recourse. I tell them if it sounds to good to be true it probably is. That’s not to say that I […]

Each day I get calls from desperate people hoping against hope the there is a magic document that can be filed or recorded the will magically give them their home free and clear without recourse. I tell them if it sounds to good to be true it probably is. That’s not to say that I […] -

Ohio Judge Steven Terry Found Guilty of Rigging Foreclosure and Mail Fraud Corruption Case AKRON, Ohio – The Cuyahoga County judge charged in the county corruption investigation for allegedly fixing a foreclosure case has been found guilty on three of the five charges he was facing. The federal jury returned the verdict

-

Lets not get to excited just yet as this comes as a complete surprise. What does this mean for the AG’s who are pursuing their own investigations and how will this help homeowners? Or is this another bailout waiting to happen? NYT- The federal agency that oversees the mortgage giants Fannie Mae and Freddie Mac is set […]

-

In case you missed it.. I put together Special Events that Happened in 1999 …Welcome to the 99 Club. It’s incomplete but it was a start to the mess we have today. AP- By PALLAVI GOGOI, AP Business Writer Counties across the United States are discovering that illegal or questionable mortgage paperwork is far more […]

-

They can start here: Deposition Transcript of Litton Loan Servicing Litigation Manager Christopher Spradling CNN- NEW YORK (CNNMoney) — The Federal Reserve issued an enforcement action Thursday against Goldman Sachs, saying the investment bank must investigate questionable lending and foreclosure practices in its mortgage unit. The action orders Goldman to hire an independent consultant to investigate […]

-

American Banker did an outstanding, superb job with this article. Please read. American Banker- Some of the largest mortgage servicers are still fabricating documents that should have been signed years ago and submitting them as evidence to foreclose on homeowners. The practice continues nearly a year after the companies were caught cutting corners in […]

-

Commonwealth of Massachusetts Southern Essex District Registry of Deeds Shetland Park 45 Congress Street Suite 4100 Salem, Massachusetts 01970 NEWS FOR IMMEDIATE RELEASE Salem, MA August 30, 2011 Contact: John O’Brien, Register of Deeds 978-542-1722 jl.obrien@sec.state.ma.us . John O’Brien, Southern Essex District Register of Deeds in Salem, […]

-

WSJ– The mortgage industry will take a step toward cleaning up some of its most controversial practices under a deal between a New York regulator and three financial firms, including Goldman Sachs Group Inc. Under the agreement with the state’s financial-services superintendent, Benjamin M. Lawsky, the three firms—Goldman, its Litton Loan Servicing […]

-

WSJ- From: Home Loan News Sent: Wednesday, August 31, 2011 4:19am Subject: Important Message From Barbara DeSoer To All IMS Associates I wanted to provide this team with information about a strategic announcement our Home Loans business will make today that is consistent with our ongoing efforts to align the business to […]

-

Aug 31 (Reuters) – Bank of New York Mellon Corp said Robert Kelly, who has held the company’s top job since 2008, has stepped down as chairman and chief executive officer, following differences in approach to managing the company. The company, one of the world’s largest custody banks, said it named board member Gerald Hassell as chairman […]

-

Bloomberg- New York Attorney General Eric Schneiderman’s office has taken testimony from 53 witnesses in its investigation into Bank of America Corp. (BAC)’s 2008 acquisition of Merrill Lynch & Co., a federal judge said. U.S. District Judge Kevin Castel in Manhattan said in an order today that “there have been 53 examinations under oath by the […]

-

UPDATE: It was announced that he’s left to spend more time with his family. According to the Yahoo Message boards: Greg Whitworth FIRED If you do a google search under cached it brings you to his info, but when clicked on the message board link it brings you or redirects one to a 404 NOT FOUND. Mysteriously his info […]

-

False Statements Limited Purpose Corporate Officers Action Date: August 31, 2011 Location: TALLAHASSEE, FL A STATEMENT ON MORTGAGE FRAUD THAT EVERY ATTORNEY GENERAL COULD ISSUE TODAY There has been widespread, well-documented abuse of corporate officer titles by banks, mortgage companies and mortgage servicing companies on mortgage-related documents. Individuals who are not corporate officers have been directed to […]

-

Hagens Berman Sobol Shapiro LLP today announced that it is investigating concerns by hedge funds and institutional investors who believe Bank of America Corp. (NYSE: BAC) may have failed to disclose to investors the risk associated with a $10 billion lawsuit threat from American International Group (“AIG”) (NYSE: AIG). According to […]

-

It’s going to tank! WSJ- Bank of America Corp. intends to sell its correspondent mortgage business, as the troubled lender looks to narrow its focus and bolster its financial strength, said people familiar with the situation. Employees could be notified as soon as Wednesday that the lender has decided to exit the […]

-

H/T David Dayen SURE DID! . For immediate release — Monday, October 6, 2008. Contact Bob Brammer – 515-281-6699 . Miller: AGs Reach Agreement with Countrywide Financial that Will Help Almost 400,000 Borrowers Facing Foreclosure The Iowa Attorney General says the settlement will offer mortgage loan modifications to more than 1,100 Iowans that will help many avoid […]

-

NEVADA vs. BANK OF AMERICA CORP. | Second Amended Complaint “The Breach, Trusts Never Became Holders of These Mortgages”” NY TIMES- The attorney general of Nevada is accusing Bank of America of repeatedly violating a broad loan modification agreement it struck with state officials in October 2008 and is seeking to rip up the deal so […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE SEE Corrective+Assignment[2] CHUTZPAH: Look it up if you are not familiar with the term. Here is a document that states on its face that Linda Green had no authority to to sign anything on behalf of MERS. So there goes thousands of documents […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE WHY DID THE LOAN SERVICER CLEAR THE LOAN OBLIGATION DOWN TO ZERO? Monday, August 29, 2011 Who owns the loan? The Ohio Supreme Court is taking up the question of what a bank needs to prove to force someone from his home. Story […]

-

MOST POPULAR ARTICLES CLICK HERE TO RESERVE SEATING AT HAWAII WORKSHOP GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE SEE US BANK OCC ORDER AND COMMENTARY It will be up on the store soon and on the American Homeowners Cooperative at http://www.Americanhomeownerscoop.com. Based upon an in depth analysis of our title and securitization combo […]

-

MOST POPULAR ARTICLES CLICK HERE TO RESERVE SEATING AT HAWAII WORKSHOP GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE Homeowner Associations Wake Up to Collections and Profit!! FORECLOSING ON THE BANK!! EDITOR’S COMMENT: Becker and Poliakoff in South Florida is probably the largest law firm representing homeowner associations in the U.S. Once upon a […]

-

MOST POPULAR ARTICLES CLICK HERE AND RESERVE SEATING NOW AT HAWAII WORKSHOP OCTOBER 14 GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE THEY WANT YOUR HOUSE!!! “The banks don’t care whether you made your payments or not. They want your house. They don’t care if someone else made your payments. They want your house. […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE EDITOR’S NOTE: IT ALL COMES DOWN TO THIS: DO YOU WANT TO SAVE THE BANKS OR DO YOU WANT TO SAVE THE COUNTRY? Submitted on 2011/08/27 at 9:20 am by Nancy Drewe National Mortgage News sign up for your own subscription first 2 […]

-

MOST POPULAR ARTICLES CLICK HERE TO RESERVE SEATING AT HAWAII WORKSHOP GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE KISS: KEEP IT SIMPLE STUPID Finality versus good and evil. In the battlefield it isn’t about good and evil. It is about winner and losers. In military battles around the world many battles have been […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE “bank is suddenly open to unlimited downside capital risk” BofA’s $8.5 Billion Settlement Could Fall Apart After Request Made To Move Mortgage Case From State To Federal Court As most know by now, the ridiculously low $8.5 billion putback settlement, which was supposed […]

-

Bombshell Admission of Failed Securitization Process in American Home Mortgage Servicing/LPS LawsuitMOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE EDITOR’S NOTE: It is comforting to know that at least some people are paying attention. From one of the largest servicers in the country comes an admission that securitization of mortgage loans was an illusion. The facts alleged by AHMSI in its lawsuit […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE “If you’re allowed to foreclose and kick someone out of his or her home without being the party that either owns the loan or represents the person who owns the loan… if you can ignore those laws, why can’t you ignore other laws […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE REFUNDABLE RESERVATION NOW TO RESERVE SEATING CLICK HERE FOR ONE DAY PASS JOIN LIVINGLIES MEMBERSHIP NOW AND GET THE AUDIO-FILE ON LAST NIGHT’S 90 MINUTE BROADCAST WITH MANDELMAN MATTERS AND LIVINGLIES WRITERS. BLOG MEMBERSHIP SUBSCRIPTION We have twice monthly teleconferences, questions and answers […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE Bank Of America’s No-Good, Very Bad Enablers By Halah Touryalai | Forbes – Mon, Aug 22, 2011 What’s the worse than Bank of America acting as if it deserves immunity from all its bad foreclosure behavior? A presidential administration that agrees. President Obama’s administration is […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE TRANSFER TO POOL AFTER FORECLOSURE INITIATED: VOID “ The fact that Deutsche had possession of the mortgage, however, is irrelevant to its status as mortgagee. While a promissory note endorsed in blank may be enforced by the party in possession of the note, […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE TENNESSEE FEDERAL COURT DENIES BANK OF AMERICA’S MOTION TO DISMISS DECLARATORY JUDGMENT ACTION CHALLENGING ALLEGED OWNERSHIP OF LOAN Today, August 23, 2011, 6 hours ago | Jeff Barnes August 23, 2011 A Tennessee Federal court has issued an Order and Memorandum denying a […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE see VIDEO $1.2 Trillion in EXTRA BAILOUT MONEY FROM FED SECRETLY GIVEN TO DOMESTIC AND FOREIGN BANKS Of course the figure is much higher, but the secrecy surrounding the money given by the Fed to the banks is something to enrage any tea […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE SEE 42-in_RE_Cruz_vs_Aurora AURORA LOAN SERVICES LLC, SCME MORTGAGE BANKERS INC, ING BANK FSB, MORTGAGE ELECTRONIC REGISTRATION SYSTEMS ALL BITE THE DUST, SUBJECT TO LIABILITY AND NO ABILITY TO FORECLOSE WITHOUT COMPLYING WITH LAW. Salient points of Judge Mann’s Decision: TRUTH IN LENDING was […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE ROBO-SIGNING IS NOW CALLED SURROGATE SIGNING AHMSI SUIT CONFIRMS PRACTICE IS WRONG, UNAUTHORIZED AND INVALID EDITOR’S NOTE: I find it interesting that LPS continued to fabricate and forge documents after AHMSI told them to stop. It could only mean that they were really […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE EDITOR’S NOTE: THE ONLY THING MISSING IS THE LARGEST QUESTION OF ALL: WERE THE MORTGAGE LIENS EVER PERFECTED? DO THEY EXIST? I also contest the issue of whether the banks were ever intending to do things right. I know from interviews I conducted […]

-

MOST POPULAR ARTICLES GET COMBO TITLE AND SECURITIZATION ANALYSIS – CLICK HERE SETTLEMENT TARGET: LABOR DAY!! “They wanted to be released from everything, including original sin,” said a U.S. official involved in the discussions. From today’s Wall Street Journal…. FORECLOSURE TALKS SNAG ON BANK LIABILITY By RUTH SIMON, VANESSA O’CONNELL and NICK TIMIRAOS Efforts to […]

<=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””> <=”” a=””>

<=”” a=””>

Losing a home is a terrible experience. We lost our home in foreclosure on September 26th, 2011.

This was just 2 short months. Today, we are still here with a new mortgage that we can afford. It’s a long story and worth reading if you’re in a similar situation. First, we went into default in November 2008. Then, we received a Notice of Trustee Sale in October 2009. After fighting the bank and trying to modify the loan we ultimately lost our home. During all this time, since 2008 we never thought to analyze the parties involved until the foreclosure actually went through. There was no third party buyer; the house just went back to the bank. Anyways, it was at this point that we were faced with an eviction situation. I started to hear about all the fraud that banks were committing in foreclosure and I was interested in having my own foreclosure analyzed. During my research I came across a company called Lighthouse Consulting Group in Orange County, Ca. I called Lighthouse and send over all the documents that were used to execute my foreclosure. It took about 1 week for them to look over the file and when they were done they found that the documents were riddled with all types of foreclosure fraud. From the Declaration of Compliance to the Substitution of Trustee, Affidavit of Mailing and even an Assignment of the Deed of Trust after the Notice of Default turned out to be a Robo-Signed document. The process used to find all this information was a Mortgage Scene Analysis and a Securitization Audit. If you’ve faced a situation similar to mine you should contact someone that can help determine what happen and then you’ll better understand your options. I reached Lighthouse at 800 520-2959.

Sam N.