BOMBSHELL- ANOTHER 2ND DCA SMACKDOWN- KONSULIAN! June 1st, 2011 Paragraph 22 of almost every mortgage contains a provision that requires the plaintiff to provide notice and an opportunity to cure the default prior to foreclosure. The principle behind this paragraph and the right to cure is not just a helpful little piece for the defendant, the default and cure provisions recited are an essential element of the entire legal process of foreclosure, deeply rooted in our American Jurisprudence. This is a subject that is discussed in some length in the recent Cardozo Law Review Article on Foreclosures. (attached) That’s all some deep stuff, but here’s where the rubber behind all that hits the road…in an opinion just released today….. Under Florida law, contracts are construed in accordance with their plain language, as bargained for by the parties. Auto-Owners Ins. Co. v. Anderson, 756 So. 2d 29, 34 (Fla. 2000). Further, Busey did not refute Konsulian’s defenses nor did it establish that Konsulian’s defenses were legally insufficient. Because Busey did not prove that it met the conditions precedent to filing for foreclosure, it failed to meet its burden, and it is not entitled to judgment as a matter of law. In addition to being prematurely filed, Konsulian claims that the acceleration letter failed to state the default as required by the mortgage terms. We agree and reverse. Now there are default letters floating all around in Foreclosureland, but I doubt that many of them comply with the express terms of the contract the banks created…..

Further, Busey did not refute Konsulian’s defenses nor did it establish that Konsulian’s defenses were legally insufficient. Because Busey did not prove that it met the conditions precedent to filing for foreclosure, it failed to meet its burden, and it is not entitled to judgment as a matter of law. In addition to being prematurely filed, Konsulian claims that the acceleration letter failed to state the default as required by the mortgage terms. We agree and reverse. Now there are default letters floating all around in Foreclosureland, but I doubt that many of them comply with the express terms of the contract the banks created…..

Tag: stop foreclosure

Possession of the note in California does not apply the whole UCC fpr that matter does not apply

Possession of the original promissory note – “Under Civil

Code section 2924, no party needs to physically possess the promissory

note.” Sicairos v. NDEX West, LLC, 2009 WL 385855 (S.D. Cal. 2009)

(citing CCC § 2924(a)(1); see also Lomboy v. SCME Mortgage Bankers,

2009 WL 1457738 * 12-13 (N.D. Cal. 2009) (“Under California law, a

trustee need not possess a note in order to initiate foreclosure under

a deed of trust.”).

Wrongfull foreclosure lawsuit vallejo

THE GREAT SECURITIZATION SCAM AND THE GREAT RECESSION

By Neil Garfield

Both the class action lawyers and the AG offices are looking for settlements that will cure the “foreclosure” problem. This is based upon the perceived benefit of getting the foreclosures either litigated or settled, SO THE “MARKET” CAN RESUME “FORWARD” MOTION. But what if the basic transaction was so defective as to be incapable of understanding, much less enforcement? We ignore the fact that the basic transaction was a lie, that lies are not enforceable and while they could be modified by agreement into enforceable written instruments (completely absent from the current landscape) the inescapable fact is that in order to do so, you will need the signature of borrowers on loans that are based upon fair market values, reality and set-off for the damages inflicted on the homeowners by the Great Securitization Scam.

So we start with the myth that there was a valid legal contract at origination, an assumption that upon examination by a paralegal, much less a first-year law student, is patently untrue. Thus we proceed with the following ten (10) lies that form the foundation of our impotent financial and economic policies in the Great Recession triggered by the housing crisis:

- 1. VALID MORTGAGE TRANSACTION: There was a loan of money, but not by either the payee, the mortgagee, the trustee or anyone else that is mentioned in the closing papers or the foreclosure papers filed anywhere. That is why the pretenders would rather play with the word “holder” than “creditor.”

- 2. LEGAL MORTGAGE TRANSACTION: Even if the right parties were at the table, the transaction was illegal because of appraisal fraud, underwriting fraud, Securities Fraud and Servicing Fraud.

- 3. LEGAL LOAN: Even if the right parties were at two different tables, the transaction was illegal because of ratings fraud, securities fraud, common law fraud, predatory loan practices and servicing fraud.

- 4. KNOWN CREDITOR: Neither the investor who was the source of funds, nor the investment banker who only committed SOME of those funds to loan transactions, nor the borrower (homeowner) even knew of the existence of each other. After the “reconstituted” bogus mortgage pools that never existed in the first place, payments by insurance, credit de fault swaps, and federal bailouts, it is at the very least a question of fact to determine the identity of the creditor at any given point in time — i.e., to whom is an obligation owed and how many parties have liability to pay on that transaction either as borrower, guarantors, insurers, or anything else? The dart board approach currently used in foreclosures and mortgage modifications, prepayments and refinancing has generally been frowned upon by the Courts.

- 5. KNOWN OBLIGATION AMOUNT: The amount advanced by the Lender (investor in bogus mortgage bonds) was far in excess of that amount used by intermediaries to fund mortgages — the rest was used to create synthetic derivative trading devices and charge fees every step of the way. Part of the difference between the funding of the residential loans and the amount advanced by the lender (investor) is easily computed by applying the same formula used to compute a yield spread premium that was paid to mortgage brokers under the table. By obscuring the real nature of the loans in the mix that offered (sold forward without ownership by the investment bank with the intent of acquiring he mortgages later) a 6% return promised to an investor could result in a yield spread premium of perhaps 12% if the loan was toxic waste and the nominal rate was 18%. Thus a $900,000 investment was converted into a $300,000 loan with no hope of repayment based upon a wildly inflated appraisal. Payments by servicers, counterparties, guarantors, insurers and bailout agencies were neither credited to the investor nor to the obligation owed to that investor. Since there was no obligor other than the homeowner according to the documents creating the securitization scam infrastructure, the borrower was part of a transaction where he “borrowed” $900,000 but only received $300,000. Third party payments made under expressly and carefully written waivers of subrogation were not applied to the amount owed to the investor and therefore not applied to the amount owed by the borrower. The absence of this information makes the servicer “accounting” a farce.

- VALID ACCOUNTING BY ALL PARTIES: Continuing with the facts illuminated in the preceding paragraph, both mortgage closing documents and foreclosure documents are devoid of any reference to the dozens of transactions carried out in the name of, or under agency of, or as constructive trustee of the investor who as lender is obliged to account for the balance due after third party payments.

Recording false documents ? and getting the house, the insurence, the tarp, the fdic guarentee, and whatever else the American taxpayer will give the pretender lender

Recently, many California Courts have been dismissing lawsuits filed to stop non-judicial foreclosures, ruling that the non-judicial foreclosure statutes occupy the field and are exclusive as long as they are complied with. Thus, in the case where a notice of default is recorded and a lawsuit then filed in response to stop the foreclosure since the foreclosing party does not possess the underlying note, all too often the Court will simply dismiss the case and claim “2924 has no requirement to produce the note.”

Thus, these Courts view the statutes that regulate non-judicial foreclosures as all inclusive of all the requirements and remedies in foreclosure proceedings. Indeed, California Civil Code sections 2924 through 2924k provide a comprehensive framework for the regulation of a nonjudicial foreclosure sale pursuant to a power of sale contained in a deed of trust. This comprehensive statutory scheme has three purposes: ‘“(1) to provide the creditor/beneficiary with a quick, inexpensive and efficient remedy against a defaulting debtor/trustor; (2) to protect the debtor/trustor from wrongful loss of the property; and (3) to ensure that a properly conducted sale is final between the parties and conclusive as to a bona fide purchaser.” [Citations.]’ [Citation.]” (Melendrez v. D & I Investment, Inc. (2005) 127 Cal.App.4th 1238, 1249–1250 [26 Cal. Rptr. 3d 413].)

Notwithstanding, the foreclosure statutes are not exclusive. If someone commits murder during an auction taking place under Civil Code 2924, that does not automatically mean they are immune from criminal and civil liability. Perhaps this is where some of these courts are “missing the boat.”

For example, in Alliance Mortgage Co. v. Rothwell (1995) 10 Cal. 4th 1226, 1231 [44 Cal. Rptr. 2d 352, 900 P.2d 601], the California Supreme Court concluded that a lender who obtained the property with a full credit bid at a foreclosure sale was not precluded from suing a third party who had fraudulently induced it to make the loan. The court concluded that “ ‘the antideficiency laws were not intended to immunize wrongdoers from the consequences of their fraudulent acts’ ” and that, if the court applies a proper measure of damages, “ ‘fraud suits do not frustrate the antideficiency policies because there should be no double recovery for the beneficiary.’ ” (Id. at p. 1238.)

Likewise, in South Bay Building Enterprises, Inc. v. Riviera Lend-Lease, Inc. [*1071] (1999) 72 Cal.App.4th 1111, 1121 [85 Cal. Rptr. 2d 647], the court held that a junior lienor retains the right to recover damages from the trustee and the beneficiary of the foreclosing lien if there have been material irregularities in the conduct of the foreclosure sale. (See also Melendrez v. D & I Investment, Inc., supra, 127 Cal.App.4th at pp. 1257–1258; Lo v. Jensen (2001) 88 Cal.App.4th 1093, 1095 [106 Cal. Rptr. 2d 443] [a trustee’s sale tainted by fraud may be set aside].)

In looking past the comprehensive statutory framework, these other Courts also considered the policies advanced by the statutory scheme, and whether those policies would be frustrated by other laws. Recently, in the case of California Golf, L.L.C. v. Cooper, 163 Cal. App. 4th 1053, 78 Cal. Rptr. 3d 153, 2008 Cal. App. LEXIS 850 (Cal. App. 2d Dist. 2008), the Appellate Court held that the remedies of 2924h were not exclusive. Of greater importance is that the Appellate Court reversed the lower court and specifically held that provisions in UCC Article 3 were allowed in the foreclosure context:

Considering the policy interests advanced by the statutory scheme governing nonjudicial foreclosure sales, and the policy interests advanced by Commercial Code section 3312, it is clear that allowing a remedy under the latter does not undermine the former. Indeed, the two remedies are complementary and advance the same goals. The first two goals of the nonjudicial foreclosure statutes: (1) to provide the creditor/beneficiary with a quick, inexpensive and efficient remedy against a defaulting debtor/trustor and (2) to protect the debtor/trustor from a wrongful loss of the property, are not impacted by the decision that we reach. This case most certainly, however, involves the third policy interest: to ensure that a properly conducted sale is final between the parties and conclusive as to a bona fide purchaser.

This is very significant since it provides further support to lawsuits brought against foreclosing parties lacking the ability toenforce the underlying note, since those laws also arise under Article 3. Under California Commercial Code 3301, a note may only be enforced if one has actual possession of the note as a holder, or has possession of the note not as a non-holder but with holder rights.

Just like in California Golf, enforcing 3301 operates to protect the debtor/trustor from a wrongful loss of the property. To the extent that a foreclosing party might argue that such lawsuits disrupt a quick, inexpensive, and efficient remedy against a defaulting debtor/trustor, the response is that “since there is no enforceable obligation, the foreclosing entity is not a party/creditor/beneficiary entitled to a quick, inexpensive, and efficient remedy,” but simply a declarant that recorded false documents.

This is primarily because being entitled to foreclose non-judicially under 2924 can only take place “after a breach of the obligation for which that mortgage or transfer is a security.” Thus, 2924 by its own terms, looks outside of the statute to the actual obligation to see if there was a breach, and if the note is unenforceable under Article 3, there can simply be no breach. End of story.

Accordingly, if there is no possession of the note or possession was not obtained until after the notice of sale was recorded, it is impossible to trigger 2924, and simple compliance with the notice requirements in 2924 does not suddenly bless the felony of grand theft of the unknown foreclosing entity. To hold otherwise would create absurd results since it would allow any person or company the right to take another persons’ home by simply recording a false notice of default and notice of sale.

Indeed, such absurdity would allow you to foreclose on your own home again to get it back should you simply record the same false documents. Thus it is obvious that these courts improperly assume the allegations contained in the notice of default and notice of sale are truthful. Perhaps these courts simply cannot or choose not to believe such frauds are taking place due to the magnitude and volume of foreclosures in this Country at this time. One can only image the chaos that would ensue in America if the truth is known that millions of foreclosures took place unlawfully and millions more are now on hold as a result of not having the ability to enforce the underlying obligation pursuant to Article 3.

So if you are in litigation to stop a foreclosure, you can probably expect the Court will want to immediately dismiss your case. These Courts just cannot understand how the law would allow someone to stay in a home without paying. Notwithstanding, laws cannot be broken, and Courts are not allowed to join with the foreclosing parties in breaking laws simply because “not paying doesn’t seem right.”

Accordingly, at least for appeal purposes, be sure to argue that 2924 was never triggered since there was never any “breach of the obligation” and that Appellate Courts throughout California have routinely held that other laws do in fact apply in the non-judicial foreclosure process since the policies advanced by the statutory non-judicial foreclosure scheme are not frustrated by these other laws. The recent exposure and discovery of Robosigners and notary fraud has added another dimension to the “exclusive 2924 argument as seen in the 22/20 special aired April 3, 2011.

Scott Pelley reports how problems with mortgage documents are prompting lawsuits and could slow down the weak housing market

Play CBS Video Video The next housing shockAs more and more Americans face mortgage foreclosure, banks’ crucial ownership documents for the properties are often unclear and are sometimes even bogus, a condition that’s causing lawsuits and hampering an already weak housing market. Scott Pelley reports.

Video Extra: Eviction reprieveFlorida residents AJ and Brenda Boyd spent more than a year trying to renegotiate their mortgage and save their home. At the last moment, questions about who owns their mortgage saved them from eviction.

Video Extra: Eviction reprieveFlorida residents AJ and Brenda Boyd spent more than a year trying to renegotiate their mortgage and save their home. At the last moment, questions about who owns their mortgage saved them from eviction. Video Extra: “Save the Dream” eventsBruce Marks, founder and CEO of the nonprofit Neighborhood Assistance Corporation of America talks to Scott Pelley about his “Save the Dream” events and how foreclosures are causing a crisis in America.

Video Extra: “Save the Dream” eventsBruce Marks, founder and CEO of the nonprofit Neighborhood Assistance Corporation of America talks to Scott Pelley about his “Save the Dream” events and how foreclosures are causing a crisis in America.

Scott Pelley explains a bizarre aftershock of the U.S. financial collapse: An epidemic of forged and missing mortgage documents.It’s bizarre but, it turns out, Wall Street cut corners when it created those mortgage-backed investments that triggered the financial collapse. Now that banks want to evict people, they’re unwinding these exotic investments to find, that often, the legal documents behind the mortgages aren’t there. Caught in a jam of their own making, some companies appear to be resorting to forgery and phony paperwork to throw people – down on their luck – out of their homes.In the 1930s we had breadlines; venture out before dawn in America today and you’ll find mortgage lines. This past January in Los Angeles, 37,000 homeowners facing foreclosure showed up to an event to beg their bank for lower payments on their mortgage. Some people even slept on the sidewalk to get in line.So many in the country are desperate now that they have to meet in convention centers coast to coast.In February in Miami, 12,000 people showed up to a similar event. The line went down the block and doubled back twice.

Video: The next housing shock

Extra: Eviction reprieve

Extra: “Save the Dream” events

Dale DeFreitas lost her job and now fears her home is next. “It’s very emotional because I just think about it. I don’t wanna lose my home. I really don’t,” she told “60 Minutes” correspondent Scott Pelley.

“It’s your American dream,” he remarked.

“It was. And still is,” she replied.

These convention center events are put on by the non-profit Neighborhood Assistance Corporation of America, which helps people figure what they can afford, and then walks them across the hall to bank representatives to ask for lower payments. More than half will get their mortgages adjusted, but the rest discover that they just can’t keep their home.

For many that’s when the real surprise comes in: these same banks have fouled up all of their own paperwork to a historic degree.

“In my mind this is an absolute, intentional fraud,” Lynn Szymoniak, who is fighting foreclosure, told Pelley.

While trying to save her house, she discovered something we did not know: back when Wall Street was using algorithms and computers to engineer those disastrous mortgage-backed securities, it appears they didn’t want old fashioned paperwork slowing down the profits.

“This was back when it was a white hot fevered pitch to move as many of these as possible,” Pelley remarked.

“Exactly. When you could make a whole lotta money through securitization. And every other aspect of it could be done electronically, you know, key strokes. This was the only piece where somebody was supposed to actually go get documents, transfer the documents from one entity to the other. And it looks very much like they just eliminated that stuff all together,” Szymoniak said.

Szymoniak’s mortgage had been bundled with thousands of others into one of those Wall Street securities traded from investor to investor. When the bank took her to court, it first said it had lost her documents, including the critical assignment of mortgage which transfers ownership. But then, there was a courthouse surprise.

“They found all of your paperwork more than a year after they initially said that they had lost it?” Pelley asked.

“Yes,” she replied.

Asked if that seemed suspicious to her, Szymoniak said, “Yes, absolutely. What do you imagine? It fell behind the file cabinet? Where was all of this? ‘We had it, we own it, we lost it.’ And then more recently, everyone is coming in saying, ‘Hey we found it. Isn’t that wonderful?'”

But what the bank may not have known is that Szymoniak is a lawyer and fraud investigator with a specialty in forged documents. She has trained FBI agents.

She told Pelley she asked for copies of those documents.

Asked what she found, Szymoniak told Pelley, “When I looked at the assignment of my mortgage, and this is the assignment: it looked that even the date they put in, which was 10/17/08, was several months after they sued me for foreclosure. So, what they were saying to the court was, ‘We sued her in July of 2008 and we acquired this mortgage in October of 2008.’ It made absolutely no sense.”

Produced by Robert Anderson and Daniel Ruetenik

Now for the pleading

Timothy L. McCandless, Esq. SBN 147715

LAW OFFICES OF TIMOTHY L. MCCANDLESS

1881 Business Center Drive, Ste. 9A

San Bernardino, CA 92392

Tel: 909/890-9192

Fax: 909/382-9956

Attorney for Plaintiffs

SUPERIOR COURT OF THE STATE OF CALIFORNIA

COUNTY OF ____________

| ___________________________________, |

And ROES 1 through 5,000,

Plaintiff,

v.

SAND CANYON CORPORATION f/k/a OPTION ONE MORTGAGE CORPORATION; AMERICAN HOME MORTGAGE SERVICES, INC.; WELLS FARGO BANK, N.A., as Trustee for SOUNDVIEW HOME LOAN TRUST 2007-OPT2; DOCX, LLC; and PREMIER TRUST DEED SERVICES and all persons unknown claiming any legal or equitable right, title, estate, lien, or interest in the property described in the complaint adverse to Plaintiff’s title, or any cloud on Plaintiff’s title thereto, Does 1 through 10, Inclusive,

Defendants.CASE NO:

FIRST AMENDED COMPLAINT

FOR QUIET TITLE, DECLARATORY RELIEF, TEMPORARY RESTRAINING ORDER, PRELIMINARY INJUNTION AND PERMANENT INJUNCTION, CANCELATION OF INSTRUMENT AND FOR DAMAGES ARISING FROM:

SLANDER OF TITLE; TORTUOUS

VIOLATION OF STATUTE [Penal

Code § 470(b) – (d); NOTARY FRAUD;

///

///

///

///

Plaintiffs ___________________________ allege herein as follows:

GENERAL ALLEGATIONS

1. Plaintiffs ___________ (hereinafter individually and collectively referred to as “___________”), were and at all times herein mentioned are, residents of the County of _________, State of California and the lawful owner of a parcel of real property commonly known as: _________________, California _______ and the legal description is:

Parcel No. 1:

A.P.N. No. _________ (hereinafter “Subject Property”).

2. At all times herein mentioned, SAND CANYON CORPORATION f/k/a OPTION ONE MORTGAGE CORPORATION (hereinafter SAND CANYON”), is and was, a corporation existing by virtue of the laws of the State of California and claims an interest adverse to the right, title and interests of Plaintiff in the Subject Property.

3. At all times herein mentioned, Defendant AMERICAN HOME MORTGAGE SERVICES, INC. (hereinafter “AMERICAN”), is and was, a corporation existing by virtue of the laws of the State of Delaware, and at all times herein mentioned was conducting ongoing business in the State of California.

4. At all times herein mentioned, Defendant WELLS FARGO BANK, N.A., as Trustee for SOUNDVIEW HOME LOAN TRUST 2007-OPT2 (hereinafter referred to as “WELLS FARGO”), is and was, a member of the National Banking Association and makes an adverse claim to the Plaintiff MADRIDS’ right, title and interest in the Subject Property.

5. At all times herein mentioned, Defendant DOCX, L.L.C. (hereinafter “DOCX”), is and was, a limited liability company existing by virtue of the laws of the State of Georgia, and a subsidiary of Lender Processing Services, Inc., a Delaware corporation.

6. At all times herein mentioned, __________________, was a company existing by virtue of its relationship as a subsidiary of __________________.

7. Plaintiffs are ignorant of the true names and capacities of Defendants sued herein as DOES I through 10, inclusive, and therefore sues these Defendants by such fictitious names and all persons unknown claiming any legal or equitable right, title, estate, lien, or interest in the property described in the complaint adverse to Plaintiffs’ title, or any cloud on Plaintiffs’ title thereto. Plaintiffs will amend this complaint as required to allege said Doe Defendants’ true names and capacities when such have been fully ascertained. Plaintiffs further allege that Plaintiffs designated as ROES 1 through 5,000, are Plaintiffs who share a commonality with the same Defendants, and as the Plaintiffs listed herein.

8. Plaintiffs are informed and believe and thereon allege that at all times herein mentioned, Defendants, and each of them, were the agent and employee of each of the remaining Defendants.

9. Plaintiffs allege that each and every defendants, and each of them, allege herein ratified the conduct of each and every other Defendant.

10. Plaintiffs allege that at all times said Defendants, and each of them, were acting within the purpose and scope of such agency and employment.

11. Plaintiffs are informed and believe and thereupon allege that circa July 2004, DOCX was formed with the specific intent of manufacturing fraudulent documents in order create the false impression that various entities obtained valid, recordable interests in real

properties, when in fact they actually maintained no lawful interest in said properties.

12. Plaintiffs are informed and believe and thereupon allege that as a regular and ongoing part of the business of Defendant DOCX was to have persons sitting around a table signing names as quickly as possible, so that each person executing documents would sign approximately 2,500 documents per day. Although the persons signing the documents claimed to be a vice president of a particular bank of that document, in fact, the party signing the name was not the person named on the document, as such the signature was a forgery, that the name of the person claiming to be a vice president of a particular financial institution was not a “vice president”, did not have any prior training in finance, never worked for the company they allegedly purported to be a vice president of, and were alleged to be a vice president simultaneously with as many as twenty different banks and/or lending institutions.

13. Plaintiffs are informed and believe and thereupon allege that the actual signatories of the instruments set forth in Paragraph 12 herein, were intended to and were fraudulently notarized by a variety of notaries in the offices of DOCX in Alpharetta, GA.

14. Plaintiffs are informed and believe and thereupon allege that for all purposes the intent of Defendant DOCX was to intentionally create fraudulent documents, with forged signatures, so that said documents could be recorded in the Offices of County Recorders through the United States of America, knowing that such documents would forgeries, contained false information, and that the recordation of such documents would affect an interest in real property in violation of law.

15. Plaintiffs allege that on or about, ____________, that they conveyed a first deed of trust (hereinafter “DEED”) in favor of Option One Mortgage, Inc. with an interest of

Interested Call our offices now!!!!

Southern California

909-890-9192

Northern California

925-957-9797

Pooling and servicing agreements PSA how it works in Judicial foreclosure states like Florida

THE ROOT OF FORECLOSURE DEFENSE The Pooling and Servicing Agreement (PSA) is the document that actually creates a residential mortgage backed securitized trust and establishes the obligations and authority of the Master Servicer and the Primary Servicer. The PSA is the heart and root of all securitized based foreclosure action defenses. The PSA establishes that mandatory rules and procedures for the sales and transfers of the mortgages and mortgage notes from the originators to the Trust. It is this unbroken chain of assignments and negotiations that creates what is called “The Alphabet Problem.” In order to understand the “Alphabet Problem,” you must keep in mind that the primary purpose of securitization is to make sure the assets (e.g., mortgage notes) are both FDIC and Bankruptcy “remote” from the originator. As a result, the common structures seek to create at least two “true sales” between the originator and the Trust. One of the defenses used by the famous Foreclosure Defender, April Charney is the following: PLAINTIFF FAILED TO COMPLY WITH APPLICABLE POOLING AND SERVICING AGREEMENT LOAN SERVICING REQUIREMENTS: Plaintiff failed to provide separate Defendants with legitimate and non predatory access to the debt management and relief that must be made available to borrowers, including this Defendant pursuant to and in accordance with the Pooling and Servicing Agreement filed by the plaintiff with the Securities and Exchange Commission that controls and applies to the subject mortgage loan. Plaintiff’s non-compliance with the conditions precedent to foreclosure imposed on the plaintiff pursuant to the applicable pooling and servicing agreement is an actionable event that makes the filing of this foreclosure premature based on a failure of a contractual and/or equitable condition precedent to foreclosure which denies Plaintiff’s ability to carry out this foreclosure. You therefore have in the most basic securitized structure the originator, the sponsor, the depositor and the Trust. I refer to these parties as the A (originator), B (sponsor), C (depositor) and D (Trust) alphabet players. The other primary but non-designated player in my alphabet game is the Master Document Custodian for the Trust. The MDC is entrusted with the physical custody of all of the “original” notes and mortgages and the assignment, sales and purchase agreements. The MDC must also execute representations and attestations that all of the transfers really and truly occurred “on time” and in the required “order” and that “true sales” occurred at each link in the chain. Section 2.01 of most PSAs includes the mandatory conveyancing rules for the Trust and the representations and warranties. The basic terms of this Section of the standard PSA is set-forth below: 2.01 Conveyance of Mortgage Loans. (a) The Depositor, concurrently with the execution and delivery hereof, hereby sells, transfers, assigns, sets over and otherwise conveys to the Trustee for the benefit of the Certificateholders, without recourse, all the right, title and interest of the Depositor in and to the Trust Fund, and the Trustee, on behalf of the Trust, hereby accepts the Trust Fund. (b) In connection with the transfer and assignment of each Mortgage Loan, the Depositor has delivered or caused to be delivered to the Trustee for the benefit of the Certificateholders the following documents or instruments with respect to each Mortgage Loan so assigned: (i) the original Mortgage Note (except for no more than up to 0.02% of the mortgage Notes for which there is a lost note affidavit and the copy of the Mortgage Note) bearing all intervening endorsements showing a complete chain of endorsement from the originator to the last endorsee, endorsed “Pay to the order of _____________, without recourse” and signed in the name of the last endorsee. To the extent that there is no room on the face of any Mortgage Note for an endorsement, the endorsement may be contained on an allonge, unless state law does not so allow and the Trustee is advised by the Responsible Party that state law does not so allow. If the Mortgage Loan was acquired by the Responsible Party in a merger, the endorsement must be by “[last endorsee], successor by merger to [name of predecessor]“. If the Mortgage Loan was acquired or originated by the last endorsee while doing business under another name, the endorsement must be by “[last endorsee], formerly known as [previous name]“; A review of all of the recent “standing” and “real party in interest” cases decided by the bankruptcy courts and the state courts in judicial foreclosure states all arise out of the inability of the mortgage servicer or the Trust to “prove up” an unbroken chain of “assignments and transfers” of the mortgage notes and the mortgages from the originators to the sponsors to the depositors to the trust and to the master document custodian for the trust. As stated in the referenced PSA, the parties have represented and warranted that there is “a complete chain of endorsements from the originator to the last endorsee” for the note. And, the Master Document Custodian must file verified reports that it in fact holds such documents with all “intervening” documents that confirm true sales at each link in the chain. The complete inability of the mortgage servicers and the Trusts to produce such unbroken chains of proof along with the original documents is the genesis for all of the recent court rulings. One would think that a simple request to the Master Document Custodian would solve these problems. However, a review of the cases reveals a massive volume of transfers and assignments executed long after the “closing date” for the Trust from the “originator” directly to the “trust.” I refer to these documents as “A to D” transfers and assignments. There are some serious problems with the A to D documents. First, at the time these documents are executed the A party has nothing to sell or transfer since the PSA provides such a sale and transfer occurred years ago. Second, the documents completely circumvent the primary objective of securitization by ignoring the “true sales” to the Sponsor (the B party) and the Depositor (the C party). In a true securitization, you would never have any direct transfers (A to D) from the originator to the trust. Third, these A to D transfers are totally inconsistent with the representations and warranties made in the PSA to the Securities and Exchange Commission and to the holders of the bonds (the “Certificateholders”) issued by the Trust. Fourth, in many cases the A to D documents are executed by parties who are not employed by the originator but who claim to have “signing authority” or some type of “agency authority” from the originator. Finally, in many of these A to D document cases the originator is legally defunct at the time the document is in fact signed or the document is signed with a current date but then states that it has an “effective date” that was one or two years earlier. Hence, we have what I call the Alphabet Problem.

AFFIRMATIVE DEFENSES AND COUNTRCLAIMS RELATED TO POOLING & SERVICING AGREEMENTS 1. Plaintiff failed to comply with the foreclosure prevention loan servicing requirement imposed on Plaintiff pursuant to the National Housing Act, 12 U.S.C. 1701x(c)(5) which requires all private lenders servicing non-federally insured home loans, including the Plaintiff, to advise borrowers, including this separate Defendant, of any home ownership counseling Plaintiff offers together with information about counseling offered by the U.S. Department of Housing and Urban Development. 2. Plaintiff cannot legally pursue foreclosure unless and until Plaintiff demonstrates compliance with 12 U.S.C. 1701x(c)(5). 3. Plaintiff failed to provide separate Defendants with legitimate and non predatory access to the debt management and relief that must be made available to borrowers, including this Defendant pursuant to and in accordance with the Pooling and Servicing Agreement filed by the plaintiff with the Securities and Exchange Commission that controls and applies to the subject mortgage loan. 4. Plaintiff’s non-compliance with the conditions precedent to foreclosure imposed on the plaintiff pursuant to the applicable pooling and servicing agreement is an actionable event that makes the filing of this foreclosure premature based on a failure of a contractual and/or equitable condition precedent to foreclosure which denies Plaintiff’s ability to carry out this foreclosure. 5. The special default loan servicing requirements contained in the subject pooling and servicing agreement are incorporated into the terms of the mortgage contract between the parties as if written therein word for word and the defendants are entitled to rely upon the servicing terms set out in that agreement. 6. Defendants are third party beneficiaries of the Plaintiff’s pooling and servicing agreement and entitled to enforce the special default servicing obligations of the plaintiff specified therein. 7. Plaintiff cannot legally pursue foreclosure unless and until Plaintiff demonstrates compliance with the foreclosure prevention servicing imposed by the subject pooling and servicing agreement under which the plaintiff owns the subject mortgage loan. 8. The section of the Pooling and Servicing Agreement (PSA) is a public document on file and online at http://www.secinfo.com and the entire pooling and servicing agreement is incorporated herein. 9. The Plaintiff failed, refused or neglected to comply, prior to the commencement of this action, with the servicing obligations specifically imposed on the plaintiff by the PSA in many particulars, including, but not limited to: a. Plaintiff failed to service and administer the subject mortgage loan in compliance with all applicable federal state and local laws. b. Plaintiff failed to service and administer the subject loan in accordance with the customary an usual standards of practice of mortgage lenders and servicers. c. Plaintiff failed to extend to defendants the opportunity and failed to permit a modification, waiver, forbearance or amendment of the terms of the subject loan or to in any way exercise the requisite judgment as is reasonably required pursuant to the PSA. 10. The Plaintiff has no right to pursue this foreclosure because the Plaintiff has failed to provide servicing of this residential mortgage loan in accordance with the controlling servicing requirements prior to filing this foreclosure action. 11. Defendants have a right to receive foreclosure prevention loan servicing from the Plaintiff before the commencement or initiation of this foreclosure action. 12. Defendants are in doubt regarding their rights and status as borrowers under the National Housing Act and also under the Pooling and Servicing Agreement filed by the plaintiff with the Securities and Exchange Commission. Defendants are now subject to this foreclosure action by reason of the above described illegal acts and omissions of the Plaintiff. 13. Defendants are being denied and deprived by Plaintiff of their right to access the required troubled mortgage loan servicing imposed on the plaintiff and applicable to the subject mortgage loan by the National Housing Act and also under the Pooling and Servicing Agreement filed by the plaintiff with the Securities and Exchange Commission. 14. Defendants are being illegally subjected by the Plaintiff to this foreclosure action, being forced to defend the same and they are being charged illegal predatory court costs and related fees, and attorney fees. Defendants are having their credit slandered and negatively affected, all of which constitutes irreparable harm to Defendants for the purpose of injunctive relief. 15. As a proximate result of the Plaintiff’s unlawful actions set forth herein, Defendants continue to suffer the irreparable harm described above for which monetary compensation is inadequate. 18. Defendants have a right to access the foreclosure prevention servicing prescribed by the National Housing Act and under the Pooling and Servicing Agreement filed by the plaintiff with the Securities and Exchange Commission which right is being denied to them by the Plaintiff. 16. These acts were wrongful and predatory acts by the plaintiff, through its predecessor in interest, and were intentional and deceptive. 17. There is a substantial likelihood that Defendants will prevail on the merits of the case.

** CONSUMER ALERT ** FRAUD WARNING REGARDING LAWSUIT MARKETERS REQUESTING UPFRONT FEES FOR SO-CALLED “MASS JOINDER” OR CLASS LITIGATION PROMISING EXTRAORDINARY HOME MORTGAGE RELIEF

The California Department of Real Estate has issued the following

“CONSUMER ALERT” warning consumers about claims being made by marketers

of “Mass Joinder” Lawsuits. I have provided two links to the California

Department’s Website containing the text of the “Alert,” but have also

re-posted it in its entirety to help broaden the distribution of the

document. Mandelman

California Department of Real Estate ** CONSUMER ALERT **

FRAUD WARNING REGARDING LAWSUIT MARKETERS REQUESTING UPFRONT FEES FOR

SO-CALLED “MASS JOINDER” OR CLASS LITIGATION PROMISING EXTRAORDINARY

HOME MORTGAGE RELIEF

By Wayne S. Bell, Chief Counsel, California Department of Real Estate

I. HOME MORTGAGE RELIEF THROUGH LITIGATION (and “Too Good to Be True”

Claims Regarding Its Use to Avoid and/or Stop Foreclosure, Obtain Loan

Principal Reduction, and to Let You Have Your Home “Free and Clear” of

Any Mortgage).

This alert is written to warn consumers about marketing companies,

unlicensed entities, lawyers, and so-called attorney-backed,

attorney-affiliated, and lawyer referral entities that offer and sell

false hope and request the payment of upfront fees for so-called “mass

joinder” or class litigation that will supposedly result in

extraordinary home mortgage relief.

The California Department of Real Estate (“DRE” or “Department”)

previously issued a consumer alert and fraud warning on loan

modification and foreclosure rescue scams in California. That alert was

followed by warnings and alerts regarding forensic loan audit fraud,

scams in connection with short sale transactions, false and misleading

designations and claims of special expertise, certifications and

credentials in connection with home loan relief services, and other real

estate and home loan relief scams.

The Department continues to administratively prosecute those who engage

in such fraud and to work in collaboration with the California State

Bar, the Federal Trade Commission, and federal, State and local criminal

law enforcement authorities to bring such frauds to justice.

On October 11, 2009, Senate Bill 94 was signed into law in California,

and it became effective that day. It prohibited any person, including

real estate licensees and attorneys, from charging, claiming, demanding,

collecting or receiving an upfront fee from a homeowner borrower in

connection with a promise to modify the borrower’s residential loan or

some other form of mortgage loan forbearance.

Senate Bill 94’s prohibitions seem to have significantly impacted the

rampant fraud that was occurring and escalating with respect to the

payment of upfront fees for loan modification work.

Also, forensic loan auditors must now register with the California

Department of Justice and cannot accept payments in advance for their

services under California law once a Notice of Default has been

recorded. There are certain exceptions for lawyers and real estate

brokers.

On January 31, 2011, an important and broad advance fee ban issued by

the Federal Trade Commission became effective and outlaws providers of

mortgage assistance relief services from requesting or collecting

advance fees from a homeowner.

Discussions about Senate Bill 94, the Federal advance fee ban, and the

Consumer Alerts of the DRE, are available on the DRE’s website at

www.dre.ca.gov.

Lawyer Exemption from the Federal Advance Fee Ban –

The advance fee ban issued by the Federal Trade Commission includes a

narrow and conditional carve out for attorneys.

If lawyers meet the following four conditions, they are generally exempt

from the rule:

1. They are engaged in the practice of law, and mortgage assistance

relief is part of their practice.

2. They are licensed in the State where the consumer or the

dwelling is located.

3. They are complying with State laws and regulations governing the

“same type of conduct the [FTC] rule requires”.

4. They place any advance fees they collect in a client trust

account and comply with State laws and regulations covering such

accounts. This requires that client funds be kept separate from the

lawyers’ personal and/or business funds until such time as the funds

have been earned.

It is important to note that the exemption for lawyers discussed above

does not allow lawyers to collect money upfront for loan modifications

or loan forbearance services, which advance fees are banned by the more

restrictive California Senate Bill 94.

But those who continue to prey on and victimize vulnerable homeowners

have not given up. They just change their tactics and modify their

sales pitches to keep taking advantage of those who are desperate to

save their homes. And some of the frauds seeking to rip off desperate

homeowners are trying to use the lawyer exemption above to collect

advance fees for mortgage assistance relief litigation.

This alert and warning is issued to call to your attention the often

overblown and exaggerated “sales pitch(es)” regarding the supposed value

of questionable “Mass Joinder” or Class Action Litigation.

Whether they call themselves Foreclosure Defense Experts, Mortgage Loan

Litigators, Living Free and Clear experts, or some other official,

important or impressive sounding title(s), individuals and companies are

marketing their services in the State of California and on the Internet.

They are making a wide variety of claims and sales pitches, and offering

impressive sounding legal and litigation services, with quite

extraordinary remedies promised, with the goal of taking and getting

some of your money.

While there are lawyers and law firms which are legitimate and

qualified to handle complex class action or joinder litigation, you must

be cautious and BEWARE. And certainly check out the lawyers on the

State Bar website and via other means, as discussed below in Section

III. II.

QUESTIONABLE AND/OR FALSE CLAIMS OF THE SO-CALLED MORTGAGE LOAN DEFENSE

OR “MASS JOINDER” AND CLASS LITIGATORS.

A. What are the Claims/Sales Pitches? They are many and varied, and

include:

1. You can join in a mass joinder or class action lawsuit already

filed against your lender and stay in your home. You can stop paying

your lender.

2. The mortgage loans can be stripped entirely from your home.

3. Your payment obligation and foreclosure against your home can be

stopped when the lawsuit is filed.

4. The litigation will take the power away from your lender.

5. A jury will side with you and against your lender.

6. The lawsuit will give you the leverage you need to stay in your

home.

7. The lawsuit may give you the right to rescind your home loan,

or to reduce your principal.

8. The lawsuit will help you modify your home loan. It will give

you a step up in the loan modification process.

9. The litigation will be performed through “powerful” litigation

attorney representation.

10. Litigation attorneys are “turning the tables on lenders and

getting cash settlements for homeowners”. In one Internet advertisement,

the marketing materials say, “the damages sought in your behalf are

nothing less than a full lien strip or in otherwords [sic] a free and

clear house if the bank can’t produce the documents they own the note on

your home. Or at the very least, damages could be awarded that would

reduce the principal balance of the note on your home to 80% of market

value, and give you a 2% interest rate for the life of the loan”.

B. Discussion.

Please don’t be fooled by slick come-ons by scammers who just want your

money. Some of the claims above might be true in a particular case,

based on the facts and evidence presented before a Court or a jury, or

have a ring or hint of truth, but you must carefully examine and analyze

each and every one of them to determine if filing a lawsuit against your

lender or joining a class or mass joinder lawsuit will have any value

for you and your situation. Be particularly skeptical of all such

claims, since agreeing to participate in 4 such litigation may require

you to pay for legal or other services, often before any legal work is

performed (e.g., a significant upfront retainer fee is required).

The reality is that litigation is time-consuming (with formal discovery

such as depositions, interrogatories, requests for documents, requests

for admissions, motions, and the like), expensive, and usually

vigorously defended. There can be no guarantees or assurances with

respect to the outcome of a lawsuit.

Even if a lender or loan owner defendant were to lose at trial, it can

appeal, and the entire process can take years. Also, there is no

statistical or other competent data that supports the claims that a mass

joinder and class action lawsuit, even if performed by a licensed,

legitimate and trained lawyer(s), will provide the remedies that the

marketers promise.

There are two other important points to be made here:

First, even assuming that the lawyers can identify fraud or other legal

violations performed by your lender in the loan origination process,

your loan may be owned by an investor – that is, someone other than your

lender. The investor will most assuredly argue that your claims against

your originating lender do not apply against the investor (the purchaser

of your loan). And even if your lender still owns the loan, they are not

legally required, absent a court judgment or order, to modify your loan

or to halt the foreclosure process if you are behind in your payments.

If they happen to lose the lawsuit, they can appeal, as noted above.

Also, the violations discovered may be minor or inconsequential, which

will not provide for any helpful remedies.

Second, and very importantly, loan modifications and other types of

foreclosure relief are simply not possible for every homeowner, and the

“success rate” is currently very low in California. This is where the

lawsuit marketing scammers come in and try to convince you that they

offer you “a leg up”. They falsely claim or suggest that they can

guarantee to stop a foreclosure in its tracks, leave you with a home

“free and clear” of any mortgage loan(s), make lofty sounding but

hollow promises, exaggerate or make bold statements regarding their

litigation successes, charge you for a retainer, and leave you with less

money.

III. THE KEY HERE IS FOR YOU TO BE ON GUARD AND CHECK THE LAWYERS OUT

(Know Who You Are or May Be Dealing With) – Do Your Own Homework (Avoid

The Traps Set by the Litigation Marketing Frauds).

Before entering into an attorney-client relationship, or paying for

“legal” or litigation services, ascertain the name of the lawyer or

lawyers who will be providing the services. Then check them out on the

State Bar’s website, at www.calbar.ca.gov. Make certain that they are

licensed by the State Bar of California. If they are licensed, see if

they have been disciplined.

Check them out through the Better Business Bureau to see if the Bureau

has received any complaints about the lawyer, law firm or marketing firm

offering the services (and remember that only lawyers can provide legal

services). And please understand that this is just another resource for

you to check, as the litigation services provider might be so new that

the Better Business Bureau may have little or nothing on them (or

something positive because of insufficient public input).

Check them out through a Google or related search on the Internet. You

may be amazed at what you can and will find out doing such a search.

Often consumers who have been scammed will post their experiences,

insights, and warnings long

before any criminal, civil or administrative action has been brought

against the scammers.

Also, ask them lots of specific, detailed questions about their

litigation experience, clients and successful results. For example, you

should ask them how many mortgage-related joinder or class lawsuits they

have filed and handled through settlement or trial. Ask them for

pleadings they have filed and news stories about their so-called

successes. Ask them for a list of current and past “satisfied” clients.

If they provide you with a list, call those people and ask those former

clients if they would use the lawyer or law firm again.

Ask the lawyers if they are class action or joinder litigation

specialists and ask them what specialist qualifications they have. Then

ask what they will actually do for you (what specific services they will

be providing and for what fees and costs). Get that in writing, and take

the time to fully understand what the attorney-client contract says and

what the end result will be before proceeding with the services.

Remember to always ask for and demand copies of all documents that you

sign.

IV. CONCLUSION.

Mortgage rescue frauds are extremely good at selling false hope to

consumers in trouble with regard to home loans. The scammers continue

to adapt and to modify their schemes as soon as their last ones became

ineffective. Promises of successes through mass joinder or class

litigation are now being marketed. Please be careful, do your own

diligence to protect yourself, and be highly suspect if anyone asks you

for money up front before doing any service on your behalf. Most

importantly, DON’T LET FRAUDS TAKE YOUR HARD EARNED MONEY.

###########

Here’s another link to the California Department of Real Estate’s page

containing this fraud warning:

FRAUD WARNING REGARDING LAWSUIT MARKETERS REQUESTING UPFRONT FEES FOR

SO-CALLED “MASS JOINDER” OR CLASS LITIGATION PROMISING EXTRAORDINARY

HOME MORTGAGE RELIEF

Obama End Run To Force deal with Banks

Administration accused of bypassing Congress in negotiating deal with banks

Washington Post Staff Writer

Wednesday, March 9, 2011; 8:55 PM

Republican lawmakers on Wednesday accused the Obama administration of trying to make an end run around Congress as it negotiates a large settlement with banks involved in shoddy foreclosure practices.

In a letter to Treasury Secretary Timothy F. Geithner, Republicans criticized the scope of a 27-page draft term sheet that was recently submitted to five of the nation’s largest banks by state attorneys general and a handful of federal agencies, including the Justice Department and the new Consumer Financial Protection Bureau.

In a letter to Treasury Secretary Timothy F. Geithner, Republicans criticized the scope of a 27-page draft term sheet that was recently submitted to five of the nation’s largest banks by state attorneys general and a handful of federal agencies, including the Justice Department and the new Consumer Financial Protection Bureau.

“The settlement agreement not only legislates new standards and practices for the servicing industry, it also resuscitates programs and policies that have not worked or that Congress has explicitly rejected,” the letter said. It was signed by nearly half a dozen Republicans, including Rep. Scott Garrett (N.J.), the lead sponsor.

The term sheet, which attempts to overhaul mortgage servicing practices, is part of broader settlement discussions that came under attack Wednesday by Sen. Richard C. Shelby (Ala.), who said the administration is politicizing the negotiations.

Shelby, the Senate banking committee’s ranking Republican, requested that the banking panel look into the discussions and asked that the administration refrain from entering into a settlement until Congress examines the matter.

“This proposed settlement appears to be an attempt to advance the administration’s political agenda, rather than an effort to help homeowners who were harmed by a servicer’s actual conduct,” he said at a Senate hearing on Wednesday.

The broad global settlement attempts to deal with the extensive foreclosure problems – including flawed or fraudulent paperwork and questions about improper or incomplete loan transfers – that surfaced in September and prompted some of the nation’s largest banks to temporarily halt foreclosures.

Although the administration has not publicly commented on the specifics, sources familiar with the negotiations have chronicled some of the details under consideration, including a push to fine the banks $20 billion or more and force them to modify troubled mortgages.

Under serious discussion is a proposal that would require banks to reduce the principal on loans of “underwater” borrowers – those who owe more on their mortgages than their homes are worth. House Republicans balked at the idea, arguing that Congress has rejected similar efforts that would have enabled bankruptcy judges to allow principal reductions.

They also questioned why the administration is considering forcing banks to use the fines to help such borrowers when the foreclosure paperwork errors that led to the settlement talks were unrelated to underwater loans. They asked Geithner to explain the legal basis “for using funds collected in an enforcement action to benefit parties who have not been harmed by the purported wrongdoing.”

Shelby singled out as problematic news reports about the role of the Consumer Financial Protection Bureau in these discussions. The bureau, led by Elizabeth Warren, has not officially opened its doors. But sources familiar with the matter say Warren is involved in negotiations with the banks.

“What is occurring appears to be nothing less than a regulatory shakedown by the new Bureau for Consumer Financial Protection, the FDIC, the Fed, certain attorneys general, and the administration,” Shelby said.

House Republicans also took issue with the bureau’s role. Without mentioning Warren, their letter asked Geithner to explain why an official from an agency that lacks regulatory or enforcement authority is part of the negotiations.

A spokeswoman for the bureau declined to comment.

The Republicans are echoing the view of many in the banking industry. On Wednesday, the Independent Community Bankers of America said in a statement that some of the proposals are a backdoor form of regulation and that they probably will “cause additional upheaval and confusion.”

To highlight their differences, House Republicans singled out part of the administration’s proposal that would improve its main foreclosure-prevention effort: the Home Affordable Modification Program. The initiative is far from reaching its initial goal of helping 3 million to 4 million borrowers. Next week, the House is expected to vote on a Republican-led bill that would kill the program.

Now they have to admit it they violated the law and will be liable for Billions

BofA, Wells, Citi see foreclosure probe fines

By Joe Rauch and Clare Baldwin

CHARLOTTE, N.C./NEW YORK | Fri Feb 25, 2011 9:20pm EST

CHARLOTTE, N.C./NEW YORK (Reuters) – Bank of America, Citigroup and Wells Fargo — three of the biggest banks in the United States — said they could face fines from a regulatory probe into the industry’s foreclosure practices.

The statements, made in regulatory filings on Friday, are the most direct admission yet from major banks that they could have to pay significant amounts of money to settle probes and lawsuits alleging that they improperly foreclosed on homes.

Bank of America Corp (BAC.N), the largest U.S. bank by assets, said the probe could lead to “material fines” and “significant” legal expenses in 2011.

Wells Fargo & Co (WFC.N), the largest U.S. mortgage lender, said it is likely to face fines or sanctions, such as a foreclosure moratorium or suspension, imposed by federal or state regulators. It said some government agency enforcement action was likely and could include civil money penalties.

Citigroup Inc (C.N) said it could pay fines or set up principal reduction programs.

The biggest U.S. mortgage lenders are being investigated by 50 state attorneys general and U.S. regulators for foreclosing on homes without having proper paperwork in place or without having properly reviewed paperwork before signing it.

The bad documentation threatens to slow down the foreclosure process and invalidate some repossessions.

Sources familiar with discussions among federal authorities have said they could seek as much as $20 billion in total from lenders to settle the foreclosure probe, which began last fall.

Analysts said the acknowledgment of potential foreclosure liabilities highlights the continuing struggles of the largest U.S. banks after the world financial crisis.

“Are they trying? Sure, but this is not an easy fix and these kinds of problems are going to hang around the banks for years,” said Matt McCormick, a portfolio manager with Cincinnati-based Bahl & Gaynor Investment Counsel.

McCormick said he has sold nearly all of his U.S. bank holdings because of concerns over foreclosures and other losses.

Beyond direct fines due to regulators, banks may also end up paying government-controlled mortgage giants Freddie Mac and Fannie Mae for the foreclosure delays.

Bank of America said it recorded $230 million in compensatory fees in the fourth quarter that it expects to owe the government mortgage companies.

The bank said its projected costs for settlements for all legal matters it is facing, including mortgage issues, could be $145 million to $1.5 billion beyond what it has already reserved.

Wells Fargo said that in the worst-case scenario, as of the end of 2010, it could have to pay $1.2 billion more than it has set aside to cover legal matters.

Citigroup said it could face up to about $4 billion more in losses from all sorts of lawsuits, including but not limited to those relating to mortgages and foreclosures.

Wells Fargo said in October that it plans to amend 55,000 foreclosure filings nationwide, amid signs that documentation for some foreclosures was incomplete or incorrect. Other banks made similar moves.

Other banks echoed the concern over foreclosures in a wave of annual report filings with the Securities and Exchange Commission on Friday.

Atlanta-based SunTrust said it expects regulators may issue a consent order, which will require the largest mortgage lenders to fix problems with their foreclosure processes, and potentially levy fines.

Wells Fargo shares closed 3.1 percent higher at $32.40 on the New York Stock Exchange. Bank of America shares closed 1.6 percent higher at $14.20 and Citi shares closed 0.2 percent higher at $4.70, also on the New York Stock Exchange.

(Reporting by Joe Rauch, Clare Baldwin and Maria Aspan; Editing by Gary Hill)

Litigation with HUD and FHA Insured Mortgage Loans and Foreclosure

When a mortgage is insured or guaranteed by the Federal Housing Administration (FHA), an agency overseen by the Department of Housing and Urban Development (HUD), servicing companies must follow HUD servicing guidelines. Some of these regulations involve the foreclosure process on a such a property, and failure to follow the guidelines may be used by homeowners to defend their foreclosure in court.

The following is a list and brief description of some of the court cases that have involved HUD and FHA loans that were improperly serviced, ones that were decided in favor of homeowners, and ones in which borrowers facing foreclosure were denied claims. Knowing some of the background of these cases may help homeowners decide if their loan is being properly serviced, or if it is worth their time to apply for an FHA loan.

One of the requirements to foreclose on a HUD loan is that the servicer must attempt to hold a face-to-face meeting with the homeowners before three payments have been missed. In Banker’s Life v. Denton, homeowners raised the failure to hold the meeting as a defense against foreclosure. Also, the servicer did not send the request for the meeting via certified mail or attempt to visit the borrowers at the property. The court found for the owners in this case.

Notices of default must also be sent to delinquent borrowers in accordance with the HUD regulations. In Federal National Mortgage Ass’n v. Moore, homeowners raised the argument that the lender had not sent out a notice of default that was in compliance with HUD’s regulations. The notice sent, according to the borrowers, was not valid because it was on a form that was not “approved by the Secretary” of HUD and was not sent in a timely manner as the regulations require.

Since these two cases had been decided, HUD’s regulations have changed, but the language of the preforeclosure servicing, including notice requirements and review guidelines, have remained the same. In fact, another court case, Mellon Mortgage Co. v. Larios, decided that the requirements are the same now as they were before the statue was revised. Lenders failing to comply with these guidelines can still be used as a defense against foreclosure.

The face-to-face meeting with homeowners is also an important aspect of foreclosing on a mortgage backed by HUD. The minimum requirement to comply with this regulation is visiting the borrowers at home and sending at least one letter via certified mail. The issue came up in Washington Mutual Bank v. Mahaffey, and the lender was denied summary judgment because it had not sent the letter, even though someone had been sent to the property to visit the homeowners.

Of course, this is not to imply that every homeowner will win a case and successfully defend against foreclosure. Courts have also ruled against borrowers who raised issues regarding servicing. In Miller v. G.E. Capital Mortgage Servs., Inc., the court ruled that private citizens have no right to sue for violations of HUD’s loss mitigation provisions. The law, according to the court, is meant to focus on regulation of lenders — not creating rights for borrowers facing foreclosure.

Also, courts have found that the language included in deeds of trust insured by the FHA are not negotiated contractual terms. Instead, they are imposed by the FHA on both the borrowers and lenders, and the borrowers may not raise defenses in relation to breach of contract if lenders fail to follow the FHA guidelines. This case was decided in Wells Fargo Home Mortgage, Inc. v. Neal. If the homeowners and mortgage company can not bargain for that aspect of the contract, there can be no breach of the contract.

Homeowners, their loss mitigation professionals, and their foreclosure attorneys should become aware of some of the issues involved with HUD loans if they have a mortgage insured by the FHA or are considering taking advantage of the new government programs. While some protections may be offered to borrowers, others seem to be taken away by the courts if there is a question about a foreclosure. Knowing the issues through previously-decided court cases can help educate borrowers.

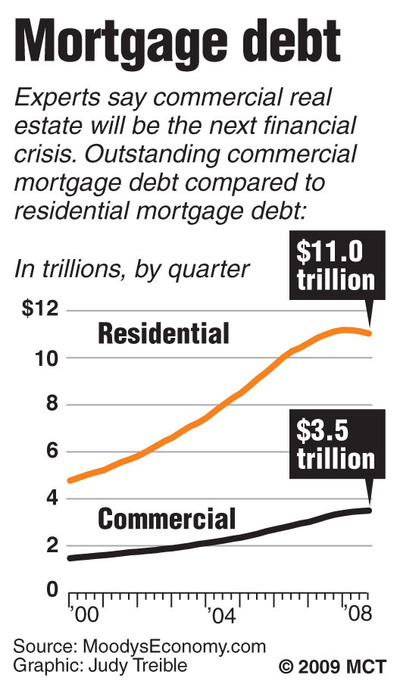

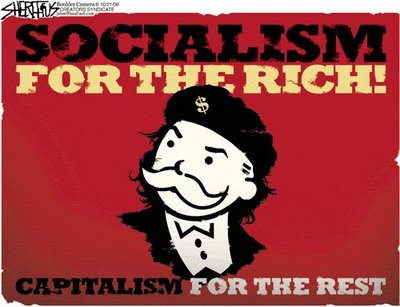

Commercial Bailout property values down 3 Trillion

The financial disaster of continuing to bailout commercial real estate through the shadows of Federal Reserve jargon. Why you haven’t heard of this trillion dollar bailout.

The financial disaster of continuing to bailout commercial real estate through the shadows of Federal Reserve jargon. Why you haven’t heard of this trillion dollar bailout.

The media has done a fantastic job painting over the enormous sinkhole of a problem that is commercial real estate (CRE). U.S. banks hold over $3 trillion in commercial real estate loans on properties that were once valued at over $6 trillion. Today those values are down to roughly $3 to $3.5 trillion depending on what metric you believe. How is it possible for a market that has lost $2.5 to $3 trillion to become largely hidden in the dark from the mainstream media? We constantly hear about $3 billion deficits or other issues but is the trillion dollar figure just so enormous that they don’t even bother investigating? It is probably more likely that the Federal Reserve has concealed massive failures in CRE by allowing banks to play a game of extend and pretend that continues today. The shadowy problems of empty shopping centers, vacant car dealership lots, and misplaced strip malls is largely a taxpayer problem now. Banks made these irresponsible loans but had the Fed hand over taxpayer loot in exchange for worthless real estate.

empty strip mall

“Another empty strip mall”

CRE bringing down FDIC banks

commercial real estate mit

Source: MIT

CRE values are still hovering near their trough and are likely to move lower. The only reason these prices haven’t moved lower is because banks are more generous with the borrowers of CRE debt since these holders are grappling with multi-million dollar cuts in each deal. Banks would rather pretend a mall is valued at $100 million instead of marking it to a real value of $40 million or less. The fact that the Federal Reserve allows this to happen is financial chicanery. Can you pretend to the government that you really don’t make $100,000 a year so instead you will act as if you make $30,000 a year and act accordingly? This is what is happening here. Banks are essentially allowing these toxic loans to be laundered through the system in exchange for taxpayer dollars. The Fed is betting that the public doesn’t wake up to this scam.

CRE is a giant and pernicious problem. With residential real estate it hits directly home and many American families are considered home owners. This bubble has garnered most media attention as it should. Yet CRE debt is enormous, larger than every state budget deficit combined by many times! In fact, the losses on CRE loans is larger than the state budget issues. Of course the Fed wants the public to look away from the real culprit behind the decline of the American middle class. The scheme was to build junk and pawn off the loans to average Americans whether they wanted to accept the debt or not.

The cost of CRE problems

commercial loans

Banks have no faith in this recovery. Look at the above regarding commercial loans. Banks continue to claim that the reason for the taxpayer bailouts was to help the American public weather the economic storm and for banks to continue lending to average Americans. Instead, as you can see above, commercial loan lending has collapsed and banks have hoarded money and speculated on the stock market casino on the taxpayer dime. This money was used to shore up bad balance sheet problems and for gambling on the stock market to boost profits. In short it was one giant swindle perpetrated on the public.

And think about the supposed recovery we are experiencing. If we were truly growing and expanding don’t you think there would be healthy demand for loans as businesses expand their workforce? Wouldn’t it be logical to conclude that commercial loans would reflect the supposed increased demand from a booming American economy? Of course the only boom occurring is for the top 1 percent who are siphoning off the wealth from average Americans to spin their continuing speculation in the stock market. Many are starting to wake up from this collective sleepwalk where taxpayers were robbed in open daylight.

The problems are coming up

Source: ZeroHedge

What is even more problematic is many of the CRE loans are going bad in the next few years. Just like residential real estate is now experiencing a second collapse, CRE will have another move lower. Banks can only carry fantasy paper for so long. So far we have been paying for it through QE1, QE2, TARP, and other convoluted programs to launder money and devalue the U.S. dollar and decrease the quality of life of average Americans. The public did not sign up for this. The banks talk about shared responsibility and many are paying for it by losing their homes and going bankrupt. Millions are facing this economic “responsibility” on a daily basis. What penalty for the banks? Instead, they get bailouts and continue to pretend the junk loans they made on concrete disasters are worth inflated values only to shovel them off to taxpayers. How is it that there are no buyers for these supposedly highly priced items?

CRE debt exposes the worst aspect of the bubble. Pure profit motive by supposed sophisticated investors on both sides of the coin with no financial responsibility or ownership. This isn’t some poor family in a low-income neighborhood taking out a subprime loan. This is actually a supposed responsible bank and a supposed financially savvy investor. There is no justification for one penny of a bailout here. Yet the Federal Reserve continues with their hidden bailout where they support malls in Oklahoma to Chick-fil-A. Don’t expect to hear about this on your nightly news

Agard MERS a nominee is not an agent

UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF NEW YORK

—————————————————————–x

In re:

Case No. 810-77338-reg

FERREL L. AGARD,

Chapter 7

Debtor.

—————————————————————–x

MEMORANDUM DECISION

Before the Court is a motion (the “Motion”) seeking relief from the automatic stay

pursuant to 11 U.S.C. § 362(d)(1) and (2), to foreclose on a secured interest in the Debtor’s real

property located in Westbury, New York (the “Property”). The movant is Select Portfolio

Servicing, Inc. (“Select Portfolio” or “Movant”), as servicer for U.S. Bank National Association,

as Trustee for First Franklin Mortgage Loan Trust 2006-FF12, Mortgage Pass-Through

Certificates, Series 2006-FF12 (“U.S. Bank”). The Debtor filed limited opposition to the Motion

contesting the Movant’s standing to seek relief from stay. The Debtor argues that the only

interest U.S. Bank holds in the underlying mortgage was received by way of an assignment from

the Mortgage Electronic Registration System a/k/a MERS, as a “nominee” for the original

lender. The Debtor’s argument raises a fundamental question as to whether MERS had the legal

authority to assign a valid and enforceable interest in the subject mortgage. Because U.S. Bank’s

rights can be no greater than the rights as transferred by its assignor – MERS – the Debtor argues

that the Movant, acting on behalf of U.S. Bank, has failed to establish that it holds an

enforceable

Case 8-10-77338-reg Doc 41 Filed 02/10/11 Entered 02/10/11 14:13:10

right against the Property.1 The Movant’s initial response to the Debtor’s opposition was that

MERS’s authority to assign the mortgage to U.S. Bank is derived from the mortgage itself which

allegedly grants to MERS its status as both “nominee” of the mortgagee and “mortgagee of

record.” The Movant later supplemented its papers taking the position that U.S. Bank is a

creditor with standing to seek relief from stay by virtue of a judgment of foreclosure and sale

entered in its favor by the state court prior to the filing of the bankruptcy. The Movant argues

that the judgment of foreclosure is a final adjudication as to U.S. Bank’s status as a secured

creditor and therefore the Rooker-Feldman doctrine prohibits this Court from looking behind the

judgment and questioning whether U.S. Bank has proper standing before this Court by virtue of a

valid assignment of the mortgage from MERS.

The Court received extensive briefing and oral argument from MERS, as an intervenor in

these proceedings which go beyond the arguments presented by the Movant. In addition to the

rights created by the mortgage documents themselves, MERS argues that the terms of its

membership agreement with the original lender and its successors in interest, as well as New

York state agency laws, give MERS the authority to assign the mortgage. MERS argues that it

holds legal title to mortgages for its member/lenders as both “nominee” and “mortgagee of

1 The Debtor also questions whether Select Portfolio has the authority and the standing to

seek relief from the automatic stay. The Movant argues that Select Portfolio has standing

to bring the Motion based upon its status as “servicer” of the Mortgage, and attaches an

affidavit of a vice president of Select Portfolio attesting to that servicing relationship.

Caselaw has established that a mortgage servicer has standing to seek relief from the

automatic stay as a party in interest. See, e.g., Greer v. O’Dell, 305 F.3d 1297

(11th Cir. 2002); In re Woodberry, 383 B.R. 373 (Bankr. D.S.C. 2008). This presumes,

however, that the lender for whom the servicer acts validly holds the subject note and

mortgage. Thus, this Decision will focus on whether U.S. Bank validly holds the subject

note and mortgage.

Page 2 of 37

Case 8-10-77338-reg Doc 41 Filed 02/10/11 Entered 02/10/11 14:13:10

record.” As such, it argues that any member/lender which holds a note secured by real property,

that assigns that note to another member by way of entry into the MERS database, need not also

assign the mortgage because legal title to the mortgage remains in the name of MERS, as agent

for any member/lender which holds the corresponding note. MERS’s position is that if a MERS

member directs it to provide a written assignment of the mortgage, MERS has the legal

authority, as an agent for each of its members, to assign mortgages to the member/lender

currently holding the note as reflected in the MERS database.

For the reasons that follow, the Debtor’s objection to the Motion is overruled and the

Motion is granted. The Debtor’s objection is overruled by application of either the Rooker-