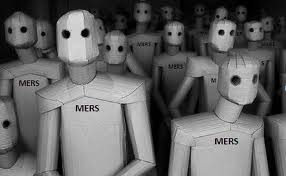

If you have been a reader of The Hallmark Abstract Sentinel then by now you are aware of MERS and the controversy that surrounds it. The Mortgage Electronic Recording System has been at the heart of questionable foreclosures due to standing issues, as well as for having aided in the avoidance of untold millions in recording fees not paid to counties.

It was only a matter of time before someone came up with a way to digitize marriage recordings in a system known as SERS, the Spouse Electronic Recording System (H/T 4closure Fraud).

SERS | SPOUSE ELECTRONIC RECORDING SYSTEM

Mike, on February 21, 2011 at 7:01 am said:

I have finally come to one conclusion: if you can’t beat ‘em, join ‘em!

My proposal is quite simple–a paperless marriage recording system, called SERS, (Spouse Electronic Recording System) for the electronic recording of marriages. To avoid the high costs of (not to mention the hassle of) the filing of marriage certificates, a SERS member would be able to simply record himself or herself as a “nominee” for A marriage to A spouse. The SERS system will record that A marriage has taken place, but the person to whom the SERS member becomes married does not have to be specified until just prior to the termination of the marriage–via divorce or death.

In this manner, one is able to “leave one’s options open.” It is a perfect system for those who would like the stability of the institution of marriage, yet, at the same time, yearn for the flexibility of non-commitment. It announces to the world, “I’m married–I’m just not saying to whom it is that I am married.”

Mind you–the flexibility provided by SERS would have its limits. For example, a SERS marriage could only be assigned to a SERS member, and the marriage would have to be “officiated” by a SERS authorized officer. Nevertheless, virtually anyone with a pulse, $25 for an official SERS certifying officer stamp, an ink jet printer, and access to a SERS terminal could become a certifying officer of SERS. (And then there is Provision K, the “Kunkle Provision,” which provides for dead certifying officers, as well.)

At the “consecration” of the relationship–which is technically an “agency relationship,” the marriage will be given a SIN number, or Spouse Identification Number. In this manner, through the SIN number, any married person can track who their actual spouse is–except in the case of most situations–where the SERS member prefers to keep that information private. Rest assured, however, if you die or if you cause a divorce, a spouse will be assigned to you at least 30 days prior to such death or divorce, except in the case of most situations, where the spousal nominator doesn’t know what the heck is going on—wherein an assignment will be backdated to reflect that the spousal assignment transpired 30 days prior to said death or divorce.

Due to the high-tech nature of the proprietary data tracking software used by SERS, only one employee of SERSCORP will be necessary, and the cost of her salary and generous bonus structure will be virtually unnoticeable as it is skimmed off one marriage transaction fee at a time as SERS marital swaps are traded seamlessly Over The Counter through Cayman Island accounts. Due to the swapping functionality enabled by their individual (original) SINs, SERS marriages will facilitate the marital churning process without the pain, humiliation, or cost of conventional marital swapping. The cost of SERS transaction fees will be recouped in the sheer volume of marital business as marriage certificates are securitized into MBS (Marriage-Backed Securities.)

Keep in mind that many marital swaps can be transacted over the life of a SERS marriage, and the nominee spouse will be unaware of such arrangements. However, therein lies the genuine excitement that only fraud-ridden obfuscation could ever bring to a marriage. (Will my nominee spouse be long? Will my nominee spouse be short? Will my nominee spouse be naked? Will my nominee spouse purchase enhancements? Will my nominee spouse be synthetic? Will my nominee spouse be square?)

At SERSCORP…we’ll put the SERS in Sersprise!

This is of course a fiction…For now!

This is just too funny – but scary… what if….