Mr. Gingrich either does not understand economics – government subsidies make things more expensive, not less expensive, and therefore hurt their intended beneficiaries – or he is a vain, selfish, and cynical man with no interest in actually helping his neighbor.

You decide.

Why is the Federal Reserve holding all these MBS? Because when “the market” collapsed in September of 2008, what really collapsed is the Fannie/Freddie/Wall Street mortgage “daisy chain” securitization scheme. As increasing numbers of MBS went into default, the purchasers of derivatives (naked insurance contracts betting on MBS default) began filing claims against the insurance writers (e.g. AIG) demanding payment. This started in February 2007 when HSBC Bank announced billions in MBS losses, gained momentum in June of 2007 when Bear Stearns announced $3.8 billion in MBS exposure in just one Bear Stearns fund, and further momentum with the actual collapse of Bear Stears in July and August of 2007. By September of 2008, the Bear Stearns collapse proved to be the canary in the coal mine as the claims on off-balance sheet derivatives became the cascading cross defaults that Alan Greenspan warned could collapse the entire Western financial system.

Part of what happened in October 2008 is that the Federal Reserve paid AIG’s and others’ derivative obligations to the insureds (pension funds, hedge funds, major banks, foreign banks) who held the naked insurance contracts guaranteeing Average Joe’s payments. To understand this, imagine that a cataclysmic event occurred in the U.S. that destroyed nearly every car in the U.S. and further that Allstate insured all of these cars. That is what happened to AIG. When the housing market collapsed and borrowers began defaulting on their securitized loans, AIG’s derivative obligations exceeded its ability (or willingness) to pay. So the Fed stepped in as the insurer of last resort and bailed out AIG (and probably others). When an insurer pays on a personal property claim, it has “subrogation” rights. This means when it pays it has the right to demand possession of the personal property it insured or seek recovery from those responsible for the loss. In Allstate’s case this is wrecked cars. In the case of AIG and the Fed, it is MBS. That is what the trillions of MBS on the Fed’s balance sheet represent: wrecked cars that Fannie and Freddie are now liquidating for scrap value.

Thank you Mr. Gingrich. Great advice.

To understand how it came to be that the Fed has paid Average Joe’s original actual lender (the MBS purchaser) and now Fannie and Freddie are trying to take Joe’s home, you first have to understand some mortgage law and securitization basics.

When you close on the purchase of your home, you sign two important documents. You sign a promissory note that represents your legal obligation to pay. You sign ONE promissory note. You sign ONE promissory note because it is a negotiable instrument, payable “to the order of” the “lender” identified in the promissory note. If you signed two promissory notes on a $300,000 loan from Countrywide, you could end up paying Countrywide (or one of its successors) $600,000.

At closing you also sign a Mortgage (or a Deed of Trust in Deed of Trust States). You may sign more than one Mortgage. You may sign more than one Mortgage because it does not represent a legal obligation to pay anything. You could sign 50 Mortgages relating to your $300,000 Countrywide loan and it would not change your obligation. A Mortgage is a security instrument. It is security and security only. Without a promissory note, a mortgage is nothing. Nothing.

You “give” or “grant” a mortgage to your original lender as security for the promise to pay as represented by the promissory note. In real estate law parlance, you “give/grant” the “mortgage” to the “holder” of your “promissory note.”

In FNBER v. IMS a mortgage assignee (IMS) claimed the ownership of two mortgages relating to loans (promissory notes) held by my client, the First National Bank of Elk River (FNBER). After a three-day trial where IMS was capably represented by a former partner of the international law firm Dorsey & Whitney, my client prevailed and the Court voided the recorded mortgage assignments to IMS. My client prevailed not because of my great skill but because it had actual, physical custody of the original promissory notes (payable to the order of my client) and had been “servicing” (receiving payments on) the loans for years notwithstanding the recorded assignment of mortgage. The facts at trial showed that IMS rejected the loans because they did not conform to their securitization parameters. In short, IMS, as the “record owner” of the mortgages without any provable connection to the underlying notes, had nothing. FNBER, on the other hand, had promissory notes payable to the order of FNBER but did not have “record title” to the mortgages. FNBER was the winner because its possession of and entitlement to enforce the notes made it the “legal owner” of the mortgages.

The lesson: if you have record title to a mortgage but cannot show that you have possession of and/or entitlement to enforce the promissory notes that the mortgage secures, you lose.

This is true for 62 million securitized loans.

There is nothing per se illegitimate about securitization. The law has for a long time recognized the rights of a noteholder to sell off pro-rata interests in the note. So long as the noteholder remains the noteholder he has the right to exercise rights in a mortgage (take the house) when there is a default on the note. Securitization does not run afoul of traditional real estate and foreclosure law when the mortgage holder can prove his connection to the noteholder.

But modern securitization doesn’t work this way.

The “securitization” of a “mortgage loan” today involves multiple parties but the most important parties and documents necessary for evaluating whether a bank has a right to foreclose on a mortgage are:

The PSA Servicer is essentially the Chief Operating Officer and driver of the PSA. Without the Servicer, the securitization car does not go. The Servicer is the entity to which Joe pays his “mortgage” (really his note, but you get it) every month. When Joe’s loan gets “sold” multiple times, the loan is not actually being sold, the servicing rights are. The Servicer has no right, title or interest in either the promissory note or the mortgage. Any right that the Servicer has to receive money is derived from the PSA. The PSA, not Joe’s Note or Joe’s Mortgage, gives the Servicer the right to take droplets of cash out of Joe’s monthly payments before distributing the remainder to MBS purchasers.

The PSA Trustee and the sanctity of the PSA Trust are vitally important to the validity of the PSA. The PSA promoters (the usual suspects, Goldman Sachs, Lehman Bros., Merrill, Deutchebank, Barclays, etc.) persuaded MBS purchasers to part with trillions of dollars based on the idea that they would ensure that Joe’s Note would be properly endorsed by every person or entity that touched it after Joe signed it, that they would place Joe’s Note and Joe’s Mortgage in the vault-like PSA Trust and the note and mortgage would remain in the PSA Trust with a green-eyeshade, PSA Trustee diligently safekeeping them for 30 years. Further, the PSA promoters hired law firms to persuade the MBS purchasers that the PSA Trust, which is more than100 percent funded (that is, oversold) by the MBS purchasers, was the real owner of Joe’s Note and Joe’s Mortgage and that the PSA Trust, using other people’s money, had purchased or soon would purchase thousands of similar notes and mortgages in a “true sale” in accordance with FASB 140.

The PSA does not distribute pool proceeds that can be tracked pro rata to identifiable loans. In this respect, in the wrong hands (e.g. Countrywide’s Angelo Mozilo) PSAs have the potential to operate like a modern “daisy chain” fraud whereby the PSA oversells the loans in the PSA Trust, thus defrauding the MBS investors. The PSA organizers also do not inform Joe at the other end of the chain that they have sold his $300,000 loan for $600,000 and that the payout to the MBS purchasers (and other derivative side-bettors) when Joe defaults is potentially multiples of $300,000.

The PSA organizers can cover the PSA’s obligations to MBS purchasers through derivatives. Derivatives are like homeowners’ fire insurance that anyone can buy. If everyone in the world can bet that Joe’s home is going to burn down and has no interest in preventing it, odds are that Joe’s home will burn down. This is part of the reason Warren Buffet called derivatives a “financial weapon of mass destruction.” They are an off-balance sheet fiat money multiplier (the Fed stopped reporting the explosive expansion of M3 in 2006 most likely because of derivatives and mortgage loan securitization fraud), and create incentive for fraud. On the other end of the chain, Joe has no idea that the “Lender” across the table from him has no skin in the game and is more than likely receiving a commission for dragging Joe to the table.

A serious problem with modern securitization is that it destroys “privity.” Privity of contract is the traditional notion that there are two parties to a contract and that only a party to the contract can enforce or renegotiate that contract. Put simply, if A and B have a contract, C cannot enforce B’s rights against A (unless A expressly agrees or C otherwise shows a lawful agency relationship with B). The frustration for Joe is that he cannot find the other party to his transaction. When Joe talks to his “bank” (really his Servicer) and tries to renegotiate his loan, his bank tells him that a mysterious “investor” will not approve. He can’t do this because they don’t exist, have been paid or don’t have the authority to negotiate Joe’s loan.

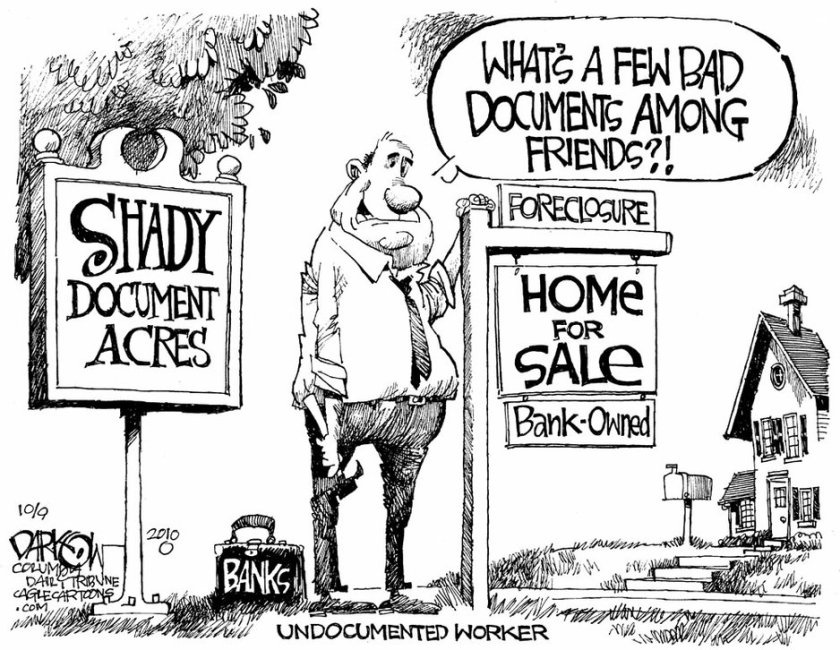

Joe’s ultimate “investor” is the Fed, as evidenced by the trillion of MBSs on its balance sheet. Although Fannie/Freddie purportedly now “own” 80 percent of all U.S. “mortgage loans,” Fannie/Freddie are really just the Fed’s repo agents. Joe has no privity relationship with Fannie/Freddie. Fannie, Freddie and the Fed know this. So they are using the Bailout Banks to frontrun the process – the Bailout Bank (who also have no cognizable connection to the note and therefore no privity relationship with Joe) conducts a fraudulent foreclosure by creating a “record title” right to foreclose and, when the fraudulent process is over, hands the bag of stolen loot (Joe’s home) to Fannie and Freddie.

Virtually all 62 million securitized notes define the “Noteholder” as “anyone who takes this Note by transfer and who is entitled to receive payment under this Note…” Very few of the holders of securitized mortgages can establish that they both hold (have physical possession of) the note AND are entitled to receive payments on the notes. For whatever reason, if a Bailout Bank has possession of an original note, it is usually endorsed payable to the order of some other (often bankrupt) entity.

If you are a Bailout Bank and you have physical possession of an original securitized note, proving that you are “entitled to receive payment” on the note is nearly impossible. First, you have to explain how you obtained the note when it should be in the hands of a PSA Trustee and it is not endorsed by the PSA Trustee. Second, even if you can show how you obtained the note, explaining why you are entitled to receive payments when you paid nothing for it and when the Fed may have satisfied your original creditors is a very difficult proposition. Third, because a mortgage is security for payments due to the noteholder and only the noteholder, if you cannot establish legal right to receive payments on the note but have a recorded mortgage all you have is “record” title to the mortgage. You have the “power” to foreclose (because courts trust recorded documents) but not necessarily the legal “right” to foreclose. Think FNBER v. IMS.

The OCC and OTS further found that the Bailout Banks “failed to sufficiently oversee outside counsel and other third-party providers handling foreclosure-related services.”

Finally, Bailout Banks consented to the OCC and OTS spanking by admitting that they have engaged in “unsafe and unsound banking practices.”

Although the OCC and OTS Orders are essentially wrist slaps for what is a massive fraud, these orders at least expose some truth. In response to the OCC Order, the Fannie/Freddie-created Mortgage Electronic Registration Systems (MERS), changed its rules (see Rule  to demand that foreclosing lawyers identify the “noteowner” prior to initiating foreclosure proceedings.

to demand that foreclosing lawyers identify the “noteowner” prior to initiating foreclosure proceedings.

Those of us fighting the banks began to see a disturbing trend starting about a year ago. Fannie and Freddie began showing up claiming title and seeking to evict homeowners from their homes.

The process works like this, using Bank of America as an example. Average Joe had a securitized loan with Countrywide. Countrywide, which might as well have been run by the Gambino family with expertise in “daisy chain” fraud, never followed the PSA, did not care for the original notes and almost never deposited the original notes in the PSA Trust. Countrywide goes belly up. Bank of America (BOA) takes over Countrywide in perhaps the worst deal in the history of corporate America, acquiring more liabilities than assets. Bank of America realizes that it has acquired a big bag of dung (no notes = no mortgages = big problem) and so sets up an entity called “BAC Home Loans LLP” whose general partner is another BOA entity.

The purpose of these BOA entities is to execute the liquidation the Countrywide portfolio as quickly as possible and, at the same time, isolate the liability to two small BOA subsidiaries. BOA uses BAC Home Loans LLP to conduct the foreclosure on Joe’s home. BAC Home Loans LLP feeds local foreclosure lawyers phony, robosigned documents that establish an “of record” transfer of the Countrywide mortgage to BAC Home Loans LLP. BAC Home Loans LLP, “purchases” Joe’s home at a Sheriff’s sale by bidding Joe’s debt owed to Countrywide. BAC Home Loans LLP does not have and cannot prove any connection to Joe’s note so BAC Home Loans LLP quickly deeds Joe’s property to Fannie and Freddie.

When it is time to kick Joe out of his home, Fannie Mae shows up in the eviction action. When compelled to show its cards, Fannie will claim title to Joe’s house via a “quit claim deed” or an assignment of the Sheriff’s Certificate of sale. Adding insult to injury, while Joe may have spent years trying to get BOA to “modify” his loan, and may have begged BOA for the right to pay BOA $1000 a month if only BOA will stop the foreclosure, Fannie now claims that BOA deeded Joe’s property to Fannie for nothing. That right, nothing. All county recorders require that a real estate purchaser claim how much they paid for the property to determine the tax value. Fannie claims on these recorded documents that it paid nothing for Joe’s home and, further, falsely claims that it is exempt because it is a US government agency. It isn’t. It is a government sponsored entity that is currently in conservatorship and run by the US government.

Great advice Newt.

It is apparent that the US government is so broke that it will do anything to pay its bills, including stealing Average Joe’s home.

That’s change that both Barack Obama and Newt Gingrich can believe in.

More and more courts are agreeing that the banks “inside” the PSA do not have legal standing (they have no skin in the game and so cannot show the necessary “injury in fact”), are not “real parties in interest” (they cannot show that they followed the terms of the PSA or are otherwise “entitled to enforce” the note) and that there are real questions of whether any securitized mortgage can ever be properly perfected.

The banks’ weakness is exposed most often in bankruptcy courts because it is there that they have to show their cards and explain how they claim a legal right, rather than the “of record” right, to foreclose the mortgage. More and more courts are recognizing that, without proof of ownership of the underlying note, holding a mortgage means nothing.

The most recent crack in the Banks’s position is evidenced by the federal Eight Circuit Court of Appeals’ decision in In Re Banks, No. 11-6025 (8th Cir., Sept. 13, 2011). In Banks, a bank attempted to execute a foreclosure within a bankruptcy case. The bank had a note payable to the order of another entity; that is, the foreclosing bank was “Bank C” but had a note payable to the order of “Bank B” and endorsed in blank by Bank B. The bank, Bank C, alleged that, because the note was endorsed in blank and “without recourse,” that it had the right to foreclose. The Court held that this was insufficient to show a sufficient chain of title to the note, reversed the lower court’s decision and remanded for findings regarding when and how Bank C acquired the note.

a. Discovery Sanctions

e. 28 U.S.C. § 1927

d. Fed. R. Evid. 702

i. Arbitration

h. 28 U.S.C. § 1927

III. CIVIL PROCEEDINGS

A. Introduction

1. Findings of Fact and Conclusions of Law

Findings of fact are reviewed for clear error. See Husain v. Olympic Airways, 316 F.3d 829, 835 (9th Cir. 2002), aff’d, 540 U.S. 644 (2004). This standard also applies to the district court’s application of law to facts where it requires an “essentially factual” review. Id. The court reviews adopted findings with close scrutiny, even though review remains to be for clear error. See Phoenix Eng’g & Supply Inc. v. Universal Elec. Co., 104 F.3d 1137, 1140 (9th Cir. 1997).

Conclusions of law are reviewed de novo. See Husain, 316 F.3d at 835. Mixed questions of law and fact are also reviewed de novo. See Lim v. City of Long Beach, 217 F.3d 1050, 1054 (9th Cir. 2000). A mixed question of law and fact exists when there is no dispute as to the facts or the rule of law and the only question is whether the facts satisfy the legal rule. See id. A district court’s interpretation of the Federal Rules of Civil Procedure is reviewed de novo. See United States v. 2,164 Watches, 366 F.3d 767, 770 (9th Cir. 2004).

2. Affirming on Alternative Grounds

The district court’s decision may be affirmed on any ground supported by the record, even if not relied upon by the district court. Forest Guardians v. U.S. Forest Serv., 329 F.3d 1089, 1097 (9th Cir. 2003).[1] Accordingly, the decision may be affirmed, “even if the district court relied on the wrong grounds or wrong reasoning.” Cigna Property and Cas. Ins. Co. v. Polaris Pictures Corp., 159 F.3d 412, 418 (9th Cir. 1998) (citation omitted).

B. Pretrial Decisions in Civil Cases

1. Absolute Immunity

Whether a public official is entitled to absolute immunity is a question of law reviewed de novo. Miller v. Davis, 521 F.3d 1142, 1145 (9th Cir. 2008) (governor).[2] A dismissal based on absolute immunity is reviewed de novo. Olsen v. Idaho State Bd. of Medicine, 363 F.3d 916, 922 (9th Cir. 2004) (state board member).

2. Abstention

This court reviews de novo whether Younger abstention is required. See Green v. City of Tucson, 255 F.3d 1086, 1093 (9th Cir. 2001) (en banc) (overruling prior cases applying abuse of discretion standard to district court’s decision whether to abstain), overruled in part on other grounds by Gilbertson v. Albright, 381 F.3d 965, 976-78 (9th Cir. 2004).

Note that Green may not apply to other abstention doctrines.[3] See Green, 255 F.3d at 1093 n.10. For example, the court of appeals reviews Pullman abstention decisions under a “modified abuse of discretion standard.” Smelt v. County of Orange, 447 F.3d 673, 678 (9th Cir. 2006). This means the court reviews de novo whether the requirements have been met, but the district court’s ultimate decision to abstain under Pullman for abuse of discretion. See id.

3. Affirmative Defenses

“[A] district court’s decisions with regard to the treatment of affirmative defenses [are] reviewed for an abuse of discretion.” 389 Orange St. Part. v. Arnold, 179 F.3d 656, 664 (9th Cir. 1999); see also In re Hanford Nuclear Reservation Litigation, 534 F.3d 986, 1000 (9th Cir. 2008). Whether an affirmative defense is waived, however, is a question of law reviewed de novo. See Owens v. Kaiser Found. Health Plan, Inc., 244 F.3d 708, 713 (9th Cir. 2001).[4]

The district court’s decision to strike certain affirmative defenses pursuant to Rule 12(f) is reviewed for an abuse of discretion. Federal Sav. & Loan Ins. Corp. v. Gemini Mgmt., 921 F.2d 241, 243-44 (9th Cir. 1990). Likewise, the decision whether to instruct the jury on affirmative defenses is reviewed for an abuse of discretion. See Costa v. Desert Palace, Inc., 299 F.3d 838, 858-59 (9th Cir. 2002) (en banc) (instructing), aff’d, 539 U.S. 90 (2003); McClaran v. Plastic Indus., Inc., 97 F.3d 347, 355-56 (9th Cir. 1996) (refusing to instruct).

4. Amended Complaints

The trial court’s denial of a motion to amend a complaint is reviewed for an abuse of discretion. See Caswell v. Calderon, 363 F.3d 832, 836 (9th Cir. 2004) (habeas); Brother Records, Inc. v. Jardine, 318 F.3d 900, 911 (9th Cir.), cert. denied, 540 U.S. 824 (2003) (finding no abuse of discretion); Chappel v. Laboratory Corp., 232 F.3d 719, 725 (9th Cir. 2000) (finding abuse of discretion). “A district court acts within its discretion to deny leave to amend when amendment would be futile, when it would cause undue prejudice to the defendant, or when it is sought in bad faith.” Chappel, 232 F.3d at 725-26. The discretion is particularly broad where a plaintiff has previously been permitted leave to amend. See Chodos v. West Publishing Co., 292 F.3d 992, 1003 (9th Cir. 2002).

The trial court’s decision to permit amendment is also reviewed for an abuse of discretion. See Metrophones Telecomms., Inc., v. Global Crossing Telecomms., Inc., 423 F.3d 1056, 1063 (9th Cir. 2005); United States v. McGee, 993 F.2d 184, 187 (9th Cir. 1993).

Dismissal of a complaint without leave to amend is improper unless it is clear, upon de novo review that the complaint could not be saved by any amendment. See Thinket Ink Info. Res., Inc. v. Sun Microsystems, Inc., 368 F.3d 1053, 1061 (9th Cir. 2004).[5]

A district court’s order denying a Rule 15(b) motion to conform the pleadings to the evidence is reviewed for an abuse of discretion. See Rosenbaum v. City and County of San Francisco, 484 F.3d 1142, 1151 (9th Cir. 2007); Madeja v. Olympic Packers, 310 F.3d 628, 635 (9th Cir. 2002). The court’s decision to grant a Rule 15(b) motion is also reviewed for an abuse of discretion. See Galindo v. Stoody Co., 793 F.2d 1502, 1512-13 (9th Cir. 1986).

The district court’s dismissal of the complaint with prejudice for failure to comply with the court’s order to amend the complaint is reviewed for an abuse of discretion. See Ordonez v. Johnson, 254 F.3d 814, 815-16 (9th Cir. 2001); McHenry v. Renne, 84 F.3d 1172, 1177 (9th Cir. 1996). Dismissal of a complaint for failure to serve a timely summons and complaint is also reviewed for abuse of discretion. See In re Sheehan, 253 F.3d 507, 511 (9th Cir. 2001); West Coast Theater Corp. v. City of Portland, 897 F.2d 1519, 1528 (9th Cir. 1990).

A district court’s decision to grant or deny a party’s request to supplement a complaint pursuant to Federal Rule of Civil Procedure 15(d) is reviewed for an abuse of discretion. Planned Parenthood of S. Ariz. v. Neely, 130 F.3d 400, 402 (9th Cir. 1997) (per curiam); Keith v. Volpe, 858 F.2d 467, 473 (9th Cir. 1988).

See also III. Civil Proceedings, B. Pretrial Decisions in Civil Cases, 55. Leave to Amend.

5. Answers

A district court’s decision to permit a party to amend its answer is reviewed for an abuse of discretion. See Waldrip v. Hall, 548 F.3d 729, 732 (9th Cir. 2008).

The court’s refusal to permit a defendant to amend pleadings to assert additional counterclaims in an answer is also reviewed for an abuse of discretion. See California Dep’t of Toxic Substances Control v. Neville Chem. Co., 358 F.3d 661, 673 (9th Cir. 2004).

The court’s decision to strike an answer and enter default judgment as a discovery sanction is reviewed for an abuse of discretion. See Fair Housing of Marin v. Combs, 285 F.3d 899, 905 (9th Cir. 2002).

6. Appointment of Counsel

“The decision to appoint counsel is left to the sound discretion of the district court.” Johnson v. United States Treasury Dep’t, 27 F.3d 415, 416‑17 (9th Cir. 1994) (per curiam) (employment discrimination) (listing factors for court to consider). The trial court’s refusal to appoint counsel is reviewed for an abuse of discretion. See Campbell v. Burt, 141 F.3d 927, 931 (9th Cir. 1998) (civil rights). The trial court’s decision on a motion for appointment of counsel pursuant to 28 U.S.C. § 1915 is also reviewed for an abuse of discretion. See Solis v. County of Los Angeles, 514 F.3d 946, 958 (9th Cir. 2008).

7. Appointment of Guardian Ad Litem

A district court’s appointment of a guardian ad litem is reviewed for an abuse of discretion. See United States v. 30.64 Acres of Land, 795 F.2d 796, 798 (9th Cir. 1986); see also Fong Sik Leung v. Dulles, 226 F.2d 74, 82 (9th Cir. 1955) (concurring opinion). The court’s determination that a guardian ad litem cannot represent a child without retaining a lawyer is a question of law reviewed de novo. See Johns v. County of San Diego, 114 F.3d 874, 876 (9th Cir. 1997).

8. Arbitration

“The district court’s decision to grant[6] or deny[7] a motion to compel arbitration is reviewed de novo.” Bushley v. Credit Suisse First Boston, 360 F.3d 1149, 1152 (9th Cir. 2004). Whether a party defaulted in arbitration is a question of fact reviewed for clear error. See Sink v. Aden Enter., Inc., 352 F.3d 1197, 1199 (9th Cir. 2003). Whether a party should be compelled back to arbitration after default is reviewed de novo. See id. at 1200.

The decision of the district court concerning whether a dispute should be referred to arbitration is a question of law reviewed de novo. See Dean Witter Reynolds, Inc. v. Byrd, 470 U.S. 213, 218 (1985) (Arbitration Act, by its terms, leaves no place for the exercise of discretion by a district court); Simula, Inc. v. Autoliv, Inc., 175 F.3d 716, 719 (9th Cir. 1999) (same). Nevertheless, “questions of arbitrability must be addressed with a healthy regard for the federal policy favoring arbitration.” Moses H. Cone Mem’l Hosp. v. Mercury Constr. Corp., 460 U.S. 1, 24 (1983).[8] Note that underlying factual findings are reviewed for clear error. See Ticknor v. Choice Hotels Int’l, Inc., 265 F.3d 931, 936 (9th Cir. 2001).

The validity and scope of an arbitration clause is reviewed de novo. See Comedy Club, Inc. v. Improv West Assoc., 553 F.3d 1277, 1284 (9th Cir. 2009); Reddam v. KPMG LLP, 457 F.3d 1054, 1058 (9th Cir. 2006); Moore v. Local 569 of Int’l Bhd. of Elec. Workers, 53 F.3d 1054, 1055 (9th Cir. 1995). Whether a party has waived its right to sue by agreeing to arbitrate is reviewed de novo. See Kummetz v. Tech Mold, Inc., 152 F.3d 1153, 1154 (9th Cir. 1998). The meaning of an agreement to arbitrate is a question of law reviewed de novo. See Wolsey, Ltd. v. Foodmaker, Inc., 144 F.3d 1205, 1211 (9th Cir. 1998).

Confirmation[9] or vacation[10] of an arbitration award is reviewed de novo. See First Options, Inc. v. Kaplan, 514 U.S. 938, 948 (1995); New Agency Productions, Inc., v. Nippon Herald Films, Inc., 501 F.3d 1101, 1105 (9th Cir. 2007); see also Poweragent v. Electronic Data Systems Corp., 358 F.3d 1187, 1193 (9th Cir. 2004) (noting review of the award is “both limited and highly deferential”).[11]

The Supreme Court has stated that “ordinary, not special standards” should be applied in reviewing the trial court’s decision upholding arbitration awards. First Options, 514 U.S. at 948. Nonetheless, a labor arbitrator’s award is entitled to “nearly unparalleled degree of deference.” See Teamsters Local Union 58 v. BOC Gases, 249 F.3d 1089, 1093 (9th Cir. 2001) (internal quotation omitted); Grammer v. Artists Agency, 287 F.3d 886, 890 (9th Cir. 2002). Courts must defer “as long as the arbitrator even arguably construed or applied the contract.” See Teamsters Local Union 58, 249 F.3d at 1093 (quoting United Paperworkers Int’l Union v. Misco, Inc., 484 U.S. 29, 38 (1987)).[12]

An arbitrator’s factual findings are presumed correct, rebuttable only by a clear preponderance of the evidence. See Grammer v. Artists Agency, 287 F.3d 886, 891 (9th Cir. 2002). Factual findings underlying the district court’s decision are reviewed for clear error. See Sink v. Aden Enter., Inc., 352 F.3d 1197, 1199 (9th Cir. 2003); Woods v. Saturn Distrib. Corp., 78 F.3d 424, 427 (9th Cir. 1996). The court’s adoption of a standard of impartiality for arbitration is reviewed de novo. See id.

Review of a foreign arbitration award is circumscribed. See China Nat. Metal Prods. Import/Export Co. v. Apex Digital, Inc., 379 F.3d 796, 799 (9th Cir. 2004) (court reviews whether the party established a defense under the Convention on the Recognition and Enforcement of Foreign Arbitral Awards, not the merits of the underlying arbitration); Ministry of Defense v. Gould, Inc., 969 F.2d 764, 770 (9th Cir. 1992) (“The court shall confirm the award unless it finds one of the grounds for refusal or deferral of recognition or enforcement of the award specified in the [New York] Convention.”).

9. Bifurcation

The trial court’s decision to bifurcate a trial is reviewed for an abuse of discretion. See Hangarter v. Provident Life and Accident Ins. Co., 373 F.3d 998, 1021 (9th Cir. 2004); Danjaq LLC v. Sony Corp., 263 F.3d 942, 961 (9th Cir. 2001) (bifurcating laches from liability at start of trial); Hilao v. Estate of Marcos, 103 F.3d 767, 782 (9th Cir. 1996) (trifurcation). The court has broad discretion to order separate trials under Federal Rule of Civil Procedure 42(b). See M2 Software, Inc. v. Madacy Entm’t, Corp., 421 F.3d 1073, 1088 (9th Cir. 2005); Zivkovic v. Southern California Edison Co., 302 F.3d 1080, 1088 (9th Cir. 2002). The court will set aside a severance order only for an abuse of discretion. See Coleman v. Quaker Oats Co., 232 F.3d 1271, 1297 (9th Cir. 2000).

10. Burden of Proof

The district’s court’s allocation of the burden of proof is a conclusion of law reviewed de novo. See Molski v. Foley Estates Vineyard and Winery, LLC, 531 F.3d 1043, 1046 (9th Cir. 2008); Ferrari, Alvarez, Olsen & Ottoboni v. Home Ins. Co., 940 F.2d 550, 555 (9th Cir. 1991).[13] Note that a trial court’s error in allocating the burden of proof is subject to harmless error analysis. See Kennedy v. Southern California Edison Co., 268 F.3d 763, 770 (9th Cir. 2001).

11. Case Management

The trial court’s decisions regarding management of litigation are reviewed only for an abuse of discretion. See Preminger v. Peake, 552 F.3d 757, 769 n.11 (9th Cir. 2008); FTC v. Enforma Natural Products, 362 F.3d 1204, 1212 (9th Cir. 2004); Jorgensen v. Cassiday, 320 F.3d 906, 913 (9th Cir. 2003) (noting “broad discretion”). District courts have inherent power to control their dockets as long as exercise of that discretion does not nullify the procedural choices reserved to parties under the federal rules. See United States v. W.R. Grace, 526 F.3d 499, 509 (9th Cir. 2008) (en banc) (noting judges have substantial discretion over what happens inside the courtroom); Southern California Edison v. Lynch, 307 F.3d 794, 807 (9th Cir. 2002) (noting due process limitations). A trial court’s decision regarding time limits on a trial is also reviewed for an abuse of discretion. See Navellier v. Sletten, 262 F.3d 923, 941-42 (9th Cir. 2001).[14] A dismissal for failure to comply with an order requiring submission of pleadings within a designated time is reviewed for an abuse of discretion. See Pagtalunan v. Galaza, 291 F.3d 639, 640 (9th Cir. 2002) (habeas).

12. Certification to State Court

Certification of a legal issue to a state court lies within the discretion of the federal court. See Micomonaco v. Washington, 45 F.3d 316, 322 (9th Cir. 1995).[15] Review of the district court’s decision whether to certify is for an abuse of discretion. Louie v. United States, 776 F.2d 819, 824 (9th Cir. 1985). Note that the court of appeals has discretion to certify questions to state courts. See Commonwealth Utils. Corp. v. Goltens Trading & Eng’g, 313 F.3d 541, 548-49 (9th Cir. 2002) (declining to certify); Ashmus v. Woodford, 202 F.3d 1160, 1164 n.6 (9th Cir. 2000) (same).

13. Claim Preclusion

See III. Civil Proceedings, B. Pretrial Decisions in Civil Cases, 71. Res Judicata.

14. Class Actions

A district court’s decision regarding class certification is reviewed for an abuse of discretion. [16] See Parra v. Bashas’, Inc., 536 F.3d 975, 977 (9th Cir. 2008); Armstrong v. Davis, 275 F.3d 849, 867 (9th Cir. 2001) (decision is subject to a “very limited” review). A court abuses its discretion if it applies an impermissible legal criterion. See Hawkins v. Comparet-Cassani, 251 F.3d 1230, 1237 (9th Cir. 2001). The district court’s decision must be supported by sufficient findings to be entitled to the traditional deference given to such a determination. See Molski v. Gleich, 318 F.3d 937, 946 (9th Cir. 2003); Local Joint Executive Trust Fund v. Las Vegas Sands, Inc., 244 F.3d 1152, 1161 (9th Cir. 2001).

Whether an ERISA claim may be brought as a class action is a question of law reviewed de novo. See Kayes v. Pacific Lumber Co., 51 F.3d 1449, 1462 (9th Cir. 1995).

Review of the district court’s rulings regarding notice is de novo. See Molski, 318 F.3d at 951; Silber v. Mabon, 18 F.3d 1449, 1453 (9th Cir. 1994). Whether notice of a proposed settlement in a class action satisfies due process is a question of law reviewed de novo. See Molski, 318 F.3d at 951; Torrisi v. Tucson Elec. Power Co., 8 F.3d 1370, 1374 (9th Cir. 1993).

The denial of a motion to opt out of a class action is reviewed for an abuse of discretion. Silber, 18 F.3d at 1455.

The district court’s decision to approve or reject a proposed settlement in a class action is reviewed for an abuse of discretion, and such review is extremely limited. See Molski, 318 F.3d at 953; In re Mego Financial Corp. Sec. Lit. (Dunleavy v. Nadler), 213 F.3d 454, 458 (9th Cir. 2000).[17]

The district court’s approval of an allocation plan for a settlement in a class action is also reviewed for an abuse of discretion. See In re Veritas Software Corp. Secs. Litigation, 496 F.3d 962, 968 (9th Cir. 2007); In re Exxon Valdez, 229 F.3d 790, 795 (9th Cir. 2000); In re Mego Financial Corp., 213 F.3d at 460. Whether the court has jurisdiction to enforce a class settlement is a question of law reviewed de novo. Arata v. Nu Skin Int’l, Inc., 96 F.3d 1265, 1268 (9th Cir. 1996).

An award of attorneys’ fees in a class action and the choice of method for determining fees are reviewed for an abuse of discretion. See Powers v. Eichen, 229 F.3d 1249, 1256 (9th Cir. 2000) (explaining the district court has broad authority over awards of attorneys’ fees in class actions).

See also III. Civil Proceedings, C. Post-Trial Decisions in Civil Cases, 2. Attorneys’ Fees, f. Class Action.

15. Collateral Estoppel

Issues regarding collateral estoppel (issue preclusion) are reviewed de novo. See Littlejohn v. United States, 321 F.3d 915, 919 (9th Cir.) (noting mixed questions of law and fact), cert. denied, 540 U.S. 985 (2003).[18] The preclusive effect of a prior judgment is a question of law reviewed de novo. See Far Out Prod., Inc. v. Oskar, 247 F.3d 986, 993 (9th Cir. 2001).[19]

16. Complaints

The trial court’s decision to permit[20] or deny[21] amendment to a complaint is reviewed for an abuse of discretion. The discretion is particularly broad where a plaintiff has previously been permitted leave to amend. See Metzler Inv. GMBH v. Corinthian Colleges, Inc., 540 F.3d 1049, 1072 (9th Cir. 2008).[22] Dismissal of a complaint without leave to amend is improper unless it is clear upon de novo review that the complaint could not be saved by any amendment. See Thinket Ink Information Res., Inc. v. Sun Microsystems, Inc., 368 F.3d 1053, 1061 (9th Cir. 2004).[23]

A district court’s order denying or granting a Rule 15(b) motion to conform the pleadings in a complaint to the evidence presented at trial is reviewed for an abuse of discretion. See Rosenbaum v. City and County of San Francisco, 484 F.3d 1142, 1151 (9th Cir. 2007) (reviewing denial of Rule 15(b) motion); Madeja v. Olympic Packers, 310 F.3d 628, 635 (9th Cir. 2002) (same); Galindo v. Stoody Co., 793 F.2d 1502, 1512-13 (9th Cir. 1986) (reviewing whether district court properly amended pleadings).

Dismissals of a complaint reviewed de novo include:

Dismissals of a complaint reviewed for abuse of discretion include:

- Dismissal with prejudice for failure to comply with the court’s order to amend the complaint. See Ordonez v. Johnson, 254 F.3d 814, 815 (9th Cir. 2001) (per curiam); McHenry v. Renne, 84 F.3d 1172, 1177 (9th Cir. 1996).

- Dismissal for failure to serve a timely summons and complaint. See In re Sheehan, 253 F.3d 507, 511 (9th Cir. 2001).

- Dismissal for failure to comply with an order requiring submission of pleadings within a designated time is reviewed for an abuse of discretion. See Pagtalunan v. Galaza, 291 F.3d 639, 640 (9th Cir. 2002) (habeas).

- A district court’s decision to grant or deny a party’s request to supplement a complaint pursuant to Rule 15(d) is reviewed for an abuse of discretion. Planned Parenthood of S. Ariz. v. Neely, 130 F.3d 400, 402 (9th Cir. 1997); Keith v. Volpe, 858 F.2d 467, 473 (9th Cir. 1988).

17. Consolidation

A district court has broad discretion to consolidate cases pending within the same district. Investors Research Co. v. United States Dist. Court, 877 F.2d 777, 777 (9th Cir. 1989); see also Pierce v. County of Orange, 526 F.3d 1190, 1203 (9th Cir. 2008). The court’s decision to deny a motion for consolidation is reviewed for an abuse of discretion. See Washington v. Daley, 173 F.3d 1158, 1169 n.13 (9th Cir. 1999).

A district court’s discretion to consolidate the hearing on a request for a preliminary injunction with the trial on the merits is “very broad and will not be overturned on appeal absent a showing of substantial prejudice in the sense that a party was not allowed to present material evidence.” Michenfelder v. Sumner, 860 F.2d 328, 337 (9th Cir. 1988) (internal quotation omitted). Ordinarily, when the district court does so, its findings of fact are reviewed for clear error and its legal conclusions are reviewed de novo. See Gentala v. City of Tucson, 244 F.3d 1065, 1071 (9th Cir.) (en banc), vacated on other grounds, 534 U.S. 946 (2001). When the facts are undisputed, however, review is de novo. Id.

The district court’s consolidation of bankruptcy proceedings is reviewed for an abuse of discretion. See In re Bonham, 229 F.3d 750, 769 (9th Cir. 2000); In re Corey, 892 F.2d 829, 836 (9th Cir. 1989). The NLRB’s refusal to consolidate separate proceedings is also reviewed for an abuse of discretion. See NLRB v. Kolkka, 170 F.3d 937, 942-43 (9th Cir. 1999).

On habeas review of a state conviction, “the propriety of a consolidation rests within the sound discretion of the state trial judge.” Fields v. Woodford, 309 F.3d 1095, 1110 (9th Cir.), amended by 315 F.3d 1062 (9th Cir. 2002) (citation omitted); Featherstone v. Estelle, 948 F.2d 1497, 1503 (9th Cir. 1991).

18. Constitutionality of Regulations

The constitutionality of a regulation is a question of law reviewed de novo. See Preminger v. Peake, 552 F.3d 757, 765 n.7 (9th Cir. 2008); Doe v. Rumsfeld, 435 F.3d 980, 984 (9th Cir. 2006); Gonzalez v. Metropolitan Transp. Auth., 174 F.3d 1016, 1018 (9th Cir. 1999); International Bhd. of Teamsters v. Department of Transp., 932 F.2d 1292, 1298 (9th Cir. 1991).

19. Constitutionality of Statutes

A challenge to the constitutionality of a federal statute is reviewed de novo. See Doe v. Rumsfeld, 435 F.3d 980, 984 (9th Cir. 2006).[24] When the district court upholds a restriction on speech, this court conducts an independent, de novo examination of the facts. See Free Speech Coalition v. Reno, 198 F.3d 1083, 1090 (9th Cir. 1999).[25]

A district court’s ruling on the constitutionality of a state statute is reviewed de novo. See American Academy of Pain Mgmt. v. Joseph, 353 F.3d 1099, 1103 (9th Cir. 2004) (reviewing California statute).[26] The severability of an unconstitutional provision of a state statute presents a question of law reviewed de novo. See Arizona Libertarian Party, Inc. v. Bayless, 351 F.3d 1277, 1283 (9th Cir. 2003). Whether a state law is subject to a facial constitutional challenge is an issue of law reviewed de novo. Southern Oregon Barter Fair v. Jackson County, Oregon, 372 F.3d 1128, 1134 (9th Cir. 2004).

20. Contempt

A court’s civil contempt order is reviewed for an abuse of discretion. Irwin v. Mascott, 370 F.3d 924, 931 (9th Cir. 2004).[27] Underlying findings made in connection with the order of civil contempt are reviewed for clear error. Id. The trial court’s decision to impose sanctions or punishment for contempt is also reviewed for abuse of discretion. Hook v. Arizona Dep’t of Corrections, 107 F.3d 1397, 1403 (9th Cir. 1997). An award of attorney’s fees for civil contempt is within the discretion of the district court. Harcourt Brace Jovanovich Legal & Professional Publications, Inc. v. Multistate Legal Studies, Inc., 26 F.3d 948, 953 (9th Cir. 1994). Whether the district court provided the alleged contemnor due process, however, is a legal question subject to de novo review. Thomas, Head & Greisen Employees Trust v. Buster, 95 F.3d 1449, 1458 (9th Cir. 1996).

The district court’s “finding” of contempt under 28 U.S.C. § 1826 is reviewed for an abuse of discretion. In re Grand Jury Proceedings, 40 F.3d 959, 961 (9th Cir. 1994).

See also III. Civil Proceedings, B. Pretrial Decisions in Civil Cases, 75. Sanctions.

21. Continuances

The decision to grant or deny a continuance is reviewed for an abuse of discretion. See Danjaq LLC v. Sony Corp., 263 F.3d 942, 961 (9th Cir. 2001). Whether a denial of a continuance constitutes an abuse of discretion depends on a consideration of the facts of each case. Hawaiian Rock Prods. Corp. v. A.E. Lopez Enters., Ltd., 74 F.3d 972, 976 (9th Cir. 1996).

The denial of a motion for a continuance of summary judgment pending further discovery is also reviewed for an abuse of discretion. See Tatum v. City and County of San Francisco, 441 F.3d 1090, 1100 (9th Cir. 2006); United States v. Kitsap Physicians Serv., 314 F.3d 995, 1000 (9th Cir. 2002).[28] A district court abuses its discretion only if the movant diligently pursued its previous discovery opportunities, and if the movant can show how allowing additional discovery would have precluded summary judgment. See Chance v. Pac-Tel Teletrac Inc., 242 F.3d 1151, 1161 n.6 (9th Cir. 2001).[29] Note that when a trial judge fails to address a Rule 56(f) motion before granting summary judgment, the omission is reviewed de novo. See Bias v. Moynihan, 508 F.3d 1212, 1223 (9th Cir. 2007); Margolis v. Ryan, 140 F.3d 850, 853 (9th Cir. 1998).

A district court’s decision to stay a civil trial is reviewed for an abuse of discretion. See Clinton v. Jones, 520 U.S. 681, 706 (1997).[30]

22. Counterclaims

Summary judgment on a counterclaim is reviewed de novo. See Cigna Property & Casualty Ins. Co. v. Polaris Pictures Corp., 159 F.3d 412, 418 (9th Cir. 1998). The dismissal of a counterclaim is reviewed de novo. See City of Auburn v. Qwest Corp., 260 F.3d 1160, 1171 (9th Cir. 2001) (ripeness), overruled on other grounds by Sprint Telephone PCS, L.P. v. County of San Diego, 543 F.3d 571 (9th Cir. 2008). The court’s refusal to strike counterclaims is reviewed de novo. See United States ex rel. Newsham v. Lockheed Missiles & Space Co., 190 F.3d 963, 968 (9th Cir. 1999).

The court’s decision to dismiss a counterclaim after voluntary dismissal of plaintiff’s claims is reviewed for an abuse to discretion. See Smith v. Lenches, 263 F.3d 972, 977 (9th Cir. 2001). The district court’s denial of leave to amend a counterclaim is reviewed for an abuse of discretion. See California Dep’t of Toxic Substances Control v. Neville Chem. Co., 358 F.3d 661, 673 (9th Cir. 2004); Unigard Sec. Ins. Co. v. Lakewood Eng’g & Mfg. Corp., 982 F.2d 363, 371 (9th Cir. 1992) (reviewing district court’s order granting leave to amend). Likewise, the court’s refusal to allow a party to add a counterclaim is reviewed for abuse of discretion. See Brother Records, Inc. v. Jardine, 318 F.3d 900, 910-11 (9th Cir.), cert. denied, 540 U.S. 824 (2003).

23. Declaratory Relief

The trial court’s decision whether to exercise jurisdiction over a declaratory judgment action is reviewed for an abuse of discretion. See Wilton v. Seven Falls Co., 515 U.S. 277, 289‑90 (1995); Rhoades v. Avon Prods., Inc., 504 F.3d 1151, 1156-57 (9th Cir. 2007).[31] A trial court may abuse its discretion by failing to provide a party an adequate opportunity to be heard when the court contemplates granting an unrequested declaratory judgment ruling. See Fordyce v. City of Seattle, 55 F.3d 436, 442 (9th Cir. 1995).

Review of the court’s decision granting or denying declaratory relief is de novo. See Wagner v. Professional Engineers in California Government, 354 F.3d 1036, 1040 (9th Cir. 2004); Ablang v. Reno, 52 F.3d 801, 803 (9th Cir. 1995).

24. Discovery

The court of appeals reviews the district court’s rulings concerning discovery for an abuse of discretion. See Preminger v. Peake, 552 F.3d 757, 768 n.10 (9th Cir. 2008); Childress v. Darby Lumber, Inc., 357 F.3d 1000, 1009 (9th Cir. 2004). “A district court is vested with broad discretion to permit or deny discovery, and a decision to deny discovery will not be disturbed except upon the clearest showing that the denial of discovery results in actual and substantial prejudice to the complaining litigant.” Laub v. United States Dep’t of Interior, 342 F.3d 1080, 1084, 1093 (9th Cir. 2003) (internal quotation marks and citation omitted).[32]

Following are specific examples of decisions related to discovery that are reviewed for abuse of discretion:

- Denial of discovery. See California Dep’t of Social Servs. v. Leavitt, 523 F.3d 1025, 1031 (9th Cir. 2008); Hall v. Norton, 266 F.3d 969, 977 (9th Cir. 2001).

- Ruling limiting the scope of discovery. See Blackburn v. United States, 100 F.3d 1426, 1436 (9th Cir. 1996).

- Decision to stay discovery. See Alaska Cargo Transp., Inc. v. Alaska R.R., 5 F.3d 378, 383 (9th Cir. 1993).

- Decision to cut off discovery. See Villegas‑Valenzuela v. INS, 103 F.3d 805, 813 (9th Cir. 1996).

- Permission of a party to withdraw a prior admission is reviewed for an abuse of discretion. See Sonoda v. Cabrera, 255 F.3d 1035, 1039 (9th Cir. 2001) (citing Fed. R. Civ. Pro. 36(b)).

- Order compelling a party to comply with discovery requests is reviewed for an abuse of discretion. Epstein v. MCA, Inc., 54 F.3d 1422, 1423 (9th Cir. 1995) (per curiam).

The district court’s decision not to permit additional discovery pursuant to Federal Rule of Civil Procedure 56(f) is also reviewed for an abuse of discretion. See Burlington Northern Santa Fe RR Co. v. Assiniboine and Sioux Tribes, 323 F.3d 767, 773-74 (9th Cir. 2003).[33] “We will only find that the district court abused its discretion if the movant diligently pursued its previous discovery opportunities, and if the movant can show how allowing additional discovery would have precluded summary judgment.” Qualls v. Blue Cross, Inc., 22 F.3d 839, 844 (9th Cir. 1994).[34] If a trial judge fails to address a Rule 56(f) motion before granting summary judgment, the omission is reviewed de novo. See Margolis v. Ryan, 140 F.3d 850, 853 (9th Cir. 1998).[35]

Whether information sought by discovery is relevant may involve an interpretation of law that is reviewed de novo. See Cacique, Inc. v. Robert Reiser & Co., 169 F.3d 619, 622 (9th Cir. 1998) (state law); but see Surfvivor Media, Inc. v. Survivor Productions, 406 F.3d 625, 630 n.2 (9th Cir. 2005). “Enforcing a discovery request for irrelevant information is a per se abuse of discretion.” Cacique, Inc., 169 F.3d at 622.

Issues regarding limitations imposed on discovery by application of the attorney‑client privilege are governed by federal common law. See Clarke v. American Commerce Nat’l Bank, 974 F.2d 127, 129 (9th Cir. 1992). The district court’s rulings on the scope of the attorney‑client privilege are reviewed de novo. See id. at 130.

A district court interpretation of 28 U.S.C. § 1782, permitting domestic discovery of use in foreign proceedings, is reviewed de novo but its application of that statute to the facts of the case is reviewed for an abuse of discretion. See Advanced Micro Devices, Inc. v. Intel Corp., 292 F.3d 664, 666 (9th Cir. 2002), aff’d, 542 U.S. 241 (2004).

a. Discovery Sanctions

The imposition of or refusal to impose discovery sanctions is reviewed for an abuse of discretion. See Childress v. Darby Lumber, Inc., 357 F.3d 1000, 1010 (9th Cir. 2004); Paladin Assocs., Inc. v. Montana Power Co., 328 F.3d 1145, 1164-65 (9th Cir. 2003).[36] Findings of fact underlying discovery sanctions are reviewed for clear error. Payne v. Exxon Corp., 121 F.3d 503, 507 (9th Cir. 1997). If the district court fails to make factual findings, the decision on a motion for sanctions is reviewed de novo. Adriana Int’l Corp. v. Thoeren, 913 F.2d 1406, 1408 (9th Cir. 1990).

Note that when the imposition of discovery sanctions turn on the resolution of a legal issue, review is de novo. See Palmer v. Pioneer Inn Assoc., Ltd., 338 F.3d 981, 985 (9th Cir. 2003). The court’s refusal to hold an evidentiary hearing prior to imposing discovery sanctions is also reviewed for an abuse of discretion. See Paladin, 328 F.3d at 1164. Whether discovery sanctions against the government are barred by sovereign immunity is a question of law reviewed de novo. United States v. Woodley, 9 F.3d 774, 781 (9th Cir. 1993).

b. Protective Orders

This court reviews the grant or denial of a protective order for an abuse of discretion. See Flatow v. Islamic Republic of Iran, 308 F.3d 1065, 1069 (9th Cir. 2002), cert. denied, 538 U.S. 944 (2003).[37] The decision whether to lift or modify a protective order is also reviewed for an abuse of discretion. Phillips ex rel. Estates of Byrd v. General Motors Corp., 307 F.3d 1206, 1210 (9th Cir. 2002); Foltz v. State Farm Mut. Auto. Ins. Co., 331 F.3d 1122, 1130 (9th Cir. 2003) (refusal to modify). Whether the lower court used the correct legal standard in granting a protective order is reviewed de novo. See Phillips ex. Rel. Estates of Byrd, 307 F.3d at 1210. When the order itself is not directly appealed, but is challenged only by the denial of a motion for reconsideration, review is for an abuse of discretion. McDowell v. Calderon, 197 F.3d 1253, 1255-56 (9th Cir. 1999) (en banc).

When reviewing a district court’s decision whether to overturn a magistrate judge’s protective order, this court reviews under a “clearly erroneous or contrary to law” standard. Rivera v. NIBCO, Inc., 364 F.3d 1057, 1063 (9th Cir. 2004).

25. Dismissals

A dismissal with leave to amend is reviewed de novo. See Kennedy v. Southern California Edison, Co., 268 F.3d 763, 767 (9th Cir. 2001); Sameena Inc. v. United States Air Force, 147 F.3d 1148, 1151 (9th Cir. 1998). Note there may be a question whether a dismissal with leave to amend is a final, appealable order. See Disabled Rights Action Committee v. Las Vegas Events, Inc., 375 F.3d 861, 870 (9th Cir. 2004); Does I thru XXIII v. Advances Textile Corp., 214 F.3d 1058, 1066-67 (9th Cir. 2000).

Note that the district court’s decision to grant leave to amend is reviewed for an abuse of discretion. See Nat’l Audubon Soc’y v. Davis, 307 F.3d 835, 853 (9th Cir.), amended by 312 F.3d 416 (9th Cir. 2002); see also Metrophones Telecomms., Inc., v. Global Crossing Telecomms., Inc., 423 F.3d 1056, 1063 (9th Cir. 2005).

A dismissal without leave to amend is reviewed de novo. See Smith v. Pacific Props. & Dev. Corp., 358 F.3d 1097, 1100 (9th Cir. 2004) (noting underlying legal determinations require de novo review); Oki Semiconductor Co. v. Wells Fargo Bank, 298 F.3d 768, 772 (9th Cir. 2002).

Dismissal without leave to amend is improper unless it is clear, upon de novo review that the complaint could not be saved by any amendment. See Thinket Ink Info Res., Inc. v. Sun Microsystems, Inc., 368 F.3d 1053, 1061 (9th Cir. 2004).[38] Dismissal of a pro se complaint without leave to amend is proper only if it is clear that the deficiencies of the complaint could not be cured by amendment. Lucas v. Department of Corrections, 66 F.3d 245, 248 (9th Cir. 1995); see also Flowers v. First Hawaiian Bank, 295 F.3d 966, 976 (9th Cir. 2002) (noting that court is cautious in approving a district court’s decision to deny pro se litigant leave to amend).

The court reviews de novo dismissals based on the following:

- Failure to state a claim pursuant to Rule 12(b)(6). See Kahle v. Gonzales, 487 F.3d 697, 699 (9th Cir. 2007); Knievel v. ESPN, 393 F.3d 1068, 1072 (9th Cir. 2005).[39] For more information, see III. Civil Proceedings, B. Pretrial Decisions in Civil Cases, 32. Failure to State a Claim.

- Venue. See Meyers v. Bennett Law Offices, 238 F.3d 1068, 1071 (9th Cir. 2001).

- Immunity. See Harvey v. Waldron, 210 F.3d 1008, 1011 (9th Cir. 2000) (judicial immunity)[40]; Blaxland v. Commonwealth Dir. of Public Prosecutions, 323 F.3d 1198, 1203 (9th Cir. 2003) (foreign sovereign immunity)[41]; Steel v. United States, 813 F.2d 1545, 1548 (9th Cir. 1987) (sovereign immunity); Manistee Town Ctr. v. City of Glendale, 227 F.3d 1090, 1092 n.2 (9th Cir. 2000) (Noerr-Pennington immunity). For more information, see III. Civil Proceedings, B. Pretrial Decisions in Civil Cases, 36. Immunities.

- Ripeness. See Manufactured Home Communities Inc. v. City of San Jose, 420 F.3d 1022, 1025 (9th Cir. 2005); Ventura Mobilehome Cmty. Owners Ass’n v. City of San Buenaventura, 371 F.3d 1046, 1050 (9th Cir. 2004).

- Feres doctrine. See Bowen v. Oistead, 125 F.3d 800, 803 (9th Cir. 1997).

- Subject matter jurisdiction. See Nuclear Info. & Res. Service v. United States Dept. of Transp., 457 F.3d 956, 958 (9th Cir. 2006); Luong v. Circuit City Stores, Inc., 368 F.3d 1109, 1111 n.2 (9th Cir. 2004).[42] Note that the court’s factual findings relevant to its determination of subject matter jurisdiction are reviewed for clear error. See Kingman Reef Atoll Invs., LLC v. United States, 541 F.3d 1189, 1195 (9th Cir. 2008); United States v. Peninsula Communications, Inc., 287 F.3d 832, 836 (9th Cir. 2002). See also III. Civil Proceedings, B. Pretrial Decisions in Civil Cases, 84. Subject Matter Jurisdiction.

- Rooker-Feldman. See Manufactured Home Communities Inc. v. City of San Jose, 420 F.3d 1022, 1025 (9th Cir. 2005); Maldonado v. Harris, 370 F.3d 945, 949 (9th Cir. 2004).

- Lack of personal jurisdiction is reviewed de novo. See Boschetto v. Hansing, 539 F.3d 1011, 1015 (9th Cir. 2008); Schwarzenegger v. Fred Martin Motor Co., 374 F.3d 797, 800 (9th Cir. 2004); Action Embroidery Corp. v. Atlantic Embroidery, Inc., 368 F.3d 1174, 1177 (9th Cir. 2004).

- Res judicata. See Maldonado v. Harris, 370 F.3d 945, 949 (9th Cir. 2004); Stewart v. U.S. Bancorp, 297 F.3d 953, 956 (9th Cir. 2002).

- Dismissal on the pleadings pursuant to Rule 12(c) is reviewed de novo. See Fairbanks North Star Borough v. United States Army Corps of Eng’rs, 543 F.3d 586, 591 (9th Cir. 2008); Dunlap v. Credit Protection Ass’n LP, 419 F.3d 1011, 1012 n.1 (9th Cir. 2005) (per curiam).

- Statute of limitations. See Lukovsky v. City & County of San Francisco, 535 F.3d 1044, 1047 (9th Cir. 2008); Ventura Mobilehome Cmty. Owners Ass’n v. City of San Buenaventura, 371 F.3d 1046, 1050 (9th Cir. 2004); Erlin v. United States, 364 F.3d 1127, 1130 (9th Cir. 2004).

- Dismissal of a prisoner’s complaint pursuant to 28 U.S.C. § 1915A. See Weilburg v. Shapiro, 488 F.3d 1202, 1205 (9th Cir. 2007); Ramirez v. Galaza, 334 F.3d 850, 853-54 (9th Cir. 2003), cert. denied, 541 U.S. 1063 (2004); Resnick v. Hayes, 213 F.3d 443, 447 (9th Cir. 2000).[43]

Dismissals based on the following are reviewed for abuse of discretion:

- Dismissal as a sanction. See Valley Eng’rs, Inc. v. Electric Eng’g Co., 158 F.3d 1051, 1052 (9th Cir. 1998) (discovery). Note that “[a] district court abuses its discretion if it imposes a sanction of dismissal without first considering the impact of the sanction and the adequacy of less drastic sanctions.” Oliva v. Sullivan, 958 F.2d 272, 274 (9th Cir. 1992) (internal quotation omitted).

- Lack of prosecution. Southwest Marine, Inc. v. Danzig, 217 F.3d 1128, 1137 n.10 (9th Cir. 2000); Dahl v. City of Huntington Beach, 84 F.3d 363, 366 (9th Cir. 1996).[44]

- Failure to comply with a court’s order to amend the complaint. Ordonez v. Johnson, 254 F.3d 814, 815 (9th Cir. 2001) (per curiam); McHenry v. Renne, 84 F.3d 1172, 1177 (9th Cir. 1996).

- Failure to comply with an order requiring submission of pleadings within a designated time. See Pagtalunan v. Galaza, 291 F.3d 639, 640 (9th Cir. 2002) (habeas).

- Failure to serve a timely summons and complaint. See In re Sheehan, 253 F.3d 507, 511 (9th Cir. 2001) (bankruptcy court); Walker v. Sumner, 14 F.3d 1415, 1422 (9th Cir. 1994) abrogated on other grounds by Sandin v. Conner, 515 U.S. 472 (1995).

- Dismissal for “judge‑shopping” made pursuant to the inherent powers of the district court. Hernandez v. City of El Monte, 138 F.3d 393, 398 (9th Cir. 1998).

- Dismissal for failure to comply with a vexatious litigant order. See In re Fillbach, 223 F.3d 1089, 1090 (9th Cir. 2000).

- Involuntary dismissals pursuant to Rule 41(b) are reviewed for abuse of discretion. See Edwards v. Marin Park, Inc., 356 F.3d 1058, 1065 (9th Cir. 2004).[45] See also III. Civil Proceedings, B. Pretrial Decisions in Civil Cases, 43. Involuntary Dismissals.

- Voluntary dismissal. See Smith v. Lenches, 263 F.3d 972, 975 (9th Cir. 2001); Hyde & Drath v. Baker, 24 F.3d 1162, 1169 (9th Cir. 1994); Bell v. Kellogg, 922 F.2d 1418, 1421-22 (9th Cir. 1991). See also III. Civil Proceedings, B. Pretrial Decisions in Civil Cases, 94. Voluntary Dismissals.

- Dismissals made pursuant to former 28 U.S.C. § 1915(d). Denton v. Hernandez, 504 U.S. 25, 33 (1992); Cato v. United States, 70 F.3d 1103, 1106 (9th Cir. 1995).

Note that § 1915(d) was recodified as 28 U.S.C. § 1915(e) by the Prison Litigation Reform Act of 1996 (PLRA). See Lopez v. Smith, 203 F.3d 1122, 1126 (9th Cir. 2000) (en banc). Dismissals pursuant to that section are reviewed de novo. See Wyatt v. Terhune, 315 F.3d 1108, 1117 (9th Cir. 2003) (reviewing exhaustion of remedies under the PLRA).[46] The court’s decision not to permit an amendment to the complaint is reviewed, however, for an abuse of discretion. See Lopez, 203 F.3d at 1130.

26. Disqualifying Counsel

The trial court’s decision ordering counsel to withdraw from a case is reviewed for an abuse of discretion. See Kayes v. Pacific Lumber Co., 51 F.3d 1449, 1464 (9th Cir. 1995). An order disqualifying an attorney will not be disturbed if the record reveals “any sound” basis for the court’s action. Paul E. Iacono Structural Eng’r, Inc. v. Humphrey, 722 F.2d 435, 438 (9th Cir. 1983). Therefore, a district court’s decision concerning the disqualification of counsel will generally not be reversed unless the court either misperceives the relevant rule of law or abuses its discretion. Id.

The denial of a motion to withdraw is also reviewed for an abuse of discretion. LaGrand v. Stewart, 133 F.3d 1253, 1269 (9th Cir. 1998) (habeas). Other actions a court may take regarding the supervision of attorneys are also reviewed for an abuse of discretion. See, e.g., Erickson v. Newmar Corp., 87 F.3d 298, 300 (9th Cir. 1996).

27. Disqualifying the Judge (Recusal)

See III. Civil Proceedings, B. Pretrial Decisions in Civil Cases, 69. Recusal .

28. Diversity Jurisdiction

A district court’s determination that diversity jurisdiction exists is reviewed de novo. See Kroske v. U.S. Bank Corp., 432 F.3d 976, 979 (9th Cir. 2005).[47] Any factual determinations necessary to establish the existence of diversity jurisdiction are reviewed for clear error. Id.[48]

The court’s decision whether state or federal law should be applied in a diversity action is reviewed de novo. See Feldman v. Allstate Ins. Co., 322 F.3d 660, 665 (9th Cir.), cert. denied, 540 U.S. 875 (2003); Torre v. Brickey, 278 F.3d 917, 919 (9th Cir. 2002). Additionally, the district court’s application of state substantive law in diversity actions is reviewed de novo. Giles v. General Motors Acceptance Corp., 494 F.3d 865, 872 (9th Cir. 2007); Prieto v. Paul Revere Life Ins. Co., 354 F.3d 1005, 1010 (9th Cir. 2004).

Note that rules regarding the appropriate standard of review, or even the availability of review at all, to be applied by a court sitting in diversity, are questions of federal law. Freund v. Nycomed Amersham, 347 F.3d 752, 762 (9th Cir. 2003).

29. Equitable Estoppel and Equitable Tolling

A district court’s decision whether to apply equitable estoppel or equitable tolling is reviewed for an abuse of discretion. Leong v. Potter, 347 F.3d 1117, 1121 (9th Cir. 2003); Johnson v. Henderson, 314 F.3d 409, 413 (9th Cir. 2002) (noting prior inconsistency).[49]

Whether a statute of limitations has been equitably tolled is generally reviewed for an abuse of discretion, unless facts are undisputed, in which case review is de novo. See Hensley v. United States, 531 F.3d 1052, 1056 (9th Cir. 2008); United States v. Battles, 362 F.3d 1195, 1196 (9th Cir. 2004) (habeas).[50]

30. Evidentiary Hearings

A district court’s decision whether to hold an evidentiary hearing is reviewed for an abuse of discretion. See Murphy v. Schneider Nat’l, Inc., 362 F.3d 1133, 1139 (9th Cir. 2004) (Rule 12(b)(3) motion).[51]

31. Exhaustion

Whether a plaintiff has exhausted required administrative remedies is a question of law reviewed de novo. See Great Basin Mine Watch v. Hankins, 456 F.3d 955, 961 (9th Cir. 2006); Bankston v. White, 345 F.3d 768, 770 (9th Cir. 2003). The question of whether administrative remedies must be exhausted is a matter of law reviewed de novo. See Chang v. United States, 327 F.3d 911, 919 (9th Cir. 2003).[52] Where exhaustion of administrative remedies is not required by statute, the decision of the district court to require exhaustion of administrative remedies is reviewed for an abuse of discretion. See Chang, 327 F.3d at 925.[53] Additionally, the court’s decision to require a party to exhaust intra-union remedies prior to filing an action under the LMRDA is reviewed for an abuse of discretion. See Kofoed v. International Bhd. of Elec., Local 48, 237 F.3d 1001, 1004 (9th Cir. 2001).

Whether a prisoner asserting a habeas claim has exhausted state remedies is a question of law reviewed de novo. See Greene v. Lambert, 288 F.3d 1081, 1086 (9th Cir. 2002). The court’s decision to dismiss a habeas petition for failure to exhaust is also reviewed de novo. See Vang v. Nevada, 329 F.3d 1069, 1072 (9th Cir. 2003).

32. Failure to State a Claim

A dismissal for failure to state a claim pursuant to Rule 12(b)(6) is reviewed de novo. See Knievel v. ESPN, 393 F.3d 1068, 1072 (9th Cir. 2005). [54] All allegations of material fact are taken as true and construed in the light most favorable to the nonmoving party. See id.[55] Conclusory allegations and unwarranted inferences, however, are insufficient to defeat a motion to dismiss. See Sanders v. Brown, 504 F.3d 903, 910 (9th Cir. 2007); Cholla Ready Mix, Inc. v. Civish, 382 F.3d 969, 973 (9th Cir. 2004).[56] A complaint should not be dismissed unless it appears beyond doubt that the plaintiff can prove no set of facts in support of the claim that would entitle the plaintiff to relief. See Homedics, Inc. v. Valley Forge Ins. Co, 315 F.3d 1135, 1138 (9th Cir. 2003); Van Buskirk v. Cable News Network, Inc., 284 F.3d 977, 980 (9th Cir. 2002).

Note that if support exists in the record, a dismissal may be affirmed on any proper ground. See Johnson v. Riverside Healthcare System, LP, 534 F.3d 1116, 1121 (9th Cir. 2008); Adams v. Johnson, 355 F.3d 1179, 1183 (9th Cir. 2004); Papa v. United States, 281 F.3d 1004, 1009 (9th Cir. 2002).

Review is generally limited to the contents of the complaint. See Marder v. Lopez,450 F.3d 445, 448 (9th Cir. 2006) (“A court may consider evidence on which the complaint ‘necessarily relies’ if: (1) the complaint refers to the document; (2) the document is central to the plaintiff’s claim; and (3) no party questions the authenticity of the copy attached to the 12(b)(6) motion.”).[57] If matters outside the pleadings are considered, the motion to dismiss under Rule 12(b)(6) is treated as one for summary judgment. See Olsen v. Idaho State Bd. of Medicine, 363 F.3d 916, 921-922 (9th Cir. 2004).[58]

33. Forum Non Conveniens

A forum non conveniens determination is committed to the sound discretion of the district court. See Harris Rutsky & Co. v. Bell & Clement, Ltd., 328 F.3d 1122, 1136 (9th Cir. 2003) (remanding for exercise of that discretion).[59] The district court’s decision “may be reversed only when there has been a clear abuse of discretion; where the court has considered all relevant public and private interest factors, and where its balancing of these factors is reasonable, its decision deserves substantial deference.” Creative Tech., Ltd. v. Aztech Sys. Pte, Ltd., 61 F.3d 696, 699 (9th Cir. 1995) (citation omitted).[60]

A district court’s decision whether to transfer pursuant to 28 U.S.C. § 1404(a) on the ground of forum non conveniens is also reviewed for an abuse of discretion. See Jones v. GNC Franchising, Inc., 211 F.3d 495, 498 (9th Cir. 2000); Lou v. Belzberg, 834 F.2d 730, 734 (9th Cir. 1987), cert. denied, 485 U.S. 993 (1998). A district court has discretion to decline jurisdiction when litigation in a foreign forum would be more convenient for the parties. See Lueck v. Sundstrand Corp., 236 F.3d 1137, 1142-43 (9th Cir. 2001).

34. Forum Selection Clauses

A district court’s decision to enforce or refusal to enforce a forum selection clause is reviewed for an abuse of discretion. See Murphy v. Schneider Nat’l, Inc., 362 F.3d 1133, 1137 (9th Cir. 2004) (enforcing forum selection clause); Fireman’s Fund Ins. v. M.V. DSR Atl., 131 F.3d 1336, 1338 (9th Cir. 1997) (refusal to enforce forum selection clause). However, note that whether the parties agreed to a forum selection clause is a question of law reviewed de novo. See Chateau Des Charmes Wines, Ltd. v. Sebate USA Inc., 328 F.3d 528, 530 (9th Cir.), cert. denied, 540 U.S. 1049 (2003). Additionally, the trial court’s interpretation of a forum selection clause is reviewed de novo. See Northern Cal. Dist. Council of Laborers v. Pittsburg‑Des Moines Steel Co., 69 F.3d 1034, 1036 n.3 (9th Cir. 1995); see also Regal-Beloit Corp. v. Kawasaki Kisen Kaisha Ltd., 557 F.3d 985, 991 (9th Cir. 2009); Richards v. Lloyd’s of London, 135 F.3d 1289, 1292 (9th Cir. 1998) (en banc) (reviewing whether federal securities laws void a choice‑of‑laws clause de novo).

35. Frivolousness

A prisoner’s lawsuit may be dismissed as frivolous pursuant to the Prison Litigation Reform Act of 1996 (PLRA), 28 U.S.C. § 1915(e). See Lopez v. Smith, 203 F.3d 1122, 1126 (9th Cir. 2000) (en banc). Dismissals under the PLRA are reviewed de novo. See Wyatt v. Terhune, 315 F.3d 1108, 1117 (9th Cir. 2003) (reviewing exhaustion of remedies under the PLRA).[61] See also III. Civil Proceedings, B. Pretrial Decisions in Civil Cases, 25. Dismissals.

Dismissal of a prisoner’s complaint pursuant to 28 U.S.C. § 1915A is reviewed de novo. See Weilburg v. Shapiro, 488 F.3d 1202, 1205 (9th Cir. 2007); Ramirez v. Galaza, 334 F.3d 850, 853-54 (9th Cir. 2003), cert. denied, 541 U.S. 1063 (2004); Resnick v. Hayes, 213 F.3d 443, 447 (9th Cir. 2000).[62]

Rule 11 sanctions based on frivolousness are reviewed for an abuse of discretion. See G.C. & K.B. Inv., Inc. v. Wilson, 326 F.3d 1096, 1109-10 (9th Cir. 2003); Christian v. Mattel, Inc., 286 F.3d 1118, 1121 (9th Cir. 2002). The court’s decision whether to award attorneys’ fees based on the pursuit of a frivolous case is also reviewed for an abuse of discretion. See United States v. Manchester Farming P’ship, 315 F.3d 1176, 1183 (9th Cir.), amended by 326 F.3d 1028 (9th Cir. 2003). Note also that the appellate court has discretion to impose attorneys’ fees and costs as a sanction for bringing a frivolous appeal. See In re George, 322 F.3d 586, 591 (9th Cir. 2003) (Rule 38); Orr v. Bank of America, 285 F.3d 764, 784 n.34 (9th Cir. 2002) (same).

36. Immunities

Immunity under the Eleventh Amendment presents questions of law reviewed de novo. See Cholla Ready Mix, Inc. v. Civish, 382 F.3d 969, 973 (9th Cir. 2004); Lovell v. Chandler, 303 F.3d 1039, 1050 (9th Cir. 2002), cert. denied, 537 U.S. 1105 (2003).[63] Whether a party is immune under the Eleventh Amendment is also reviewed de novo. See Holz v. Nenana City Pub. Sch. Dist., 347 F.3d 1176, 1179 (9th Cir. 2003).[64]

Whether a judge is protected from suit by judicial immunity is a question of law reviewed de novo. See Harvey v. Waldron, 210 F.3d 1008, 1011 (9th Cir. 2000); Crooks v. Maynard, 913 F.2d 699, 700 (9th Cir. 1990). The district court’s conclusion that an individual is entitled to judicial immunity is also reviewed de novo. See Bennett v. Williams, 892 F.2d 822, 823 (9th Cir. 1989) (individual acting within judicially-conferred authority). A dismissal based on judicial immunity is reviewed de novo. See Harvey, 210 F.3d at 1011.[65]

Whether a public official is entitled to absolute immunity is a question of law reviewed de novo. See Brown v. California Dep’t of Corrections, 554 F.3d 747, 749-50 (9th Cir. 2009).[66] A dismissal based on absolute immunity is reviewed de novo. See Olsen v. Idaho State Bd. of Medicine, 363 F.3d 916, 922 (9th Cir. 2004) (state board members).

Whether an individual is entitled to legislative immunity is a question of law reviewed de novo. See Kaahumanu v. County of Maui, 315 F.3d 1215, 1219 (9th Cir. 2003); San Pedro Hotel Co. v. City of Los Angeles, 159 F.3d 470, 476 (9th Cir. 1998); see also Chappell v. Robbins, 73 F.3d 918, 920 (9th Cir. 1996) (reviewing de novo dismissal based on absolute legislative immunity).

Consular immunity is reviewed de novo. See Park v. Shin, 313 F.3d 1138, 1141 (9th Cir. 2002); Joseph v. Office of Consulate General of Nigeria, 830 F.2d 1018, 1027 (9th Cir. 1987).

A district court’s decision on qualified immunity is reviewed de novo. See Elder v. Holloway, 510 U.S. 510, 516 (1994).[67] The type of immunity to which a public official is entitled is a question of law reviewed de novo. See Mabe v. San Bernardino County, 237 F.3d 1101, 1106 (9th Cir. 2001); Greater Los Angeles Council on Deafness, Inc. v. Zolin, 812 F.2d 1103, 1109 n.7 (9th Cir. 1987). The court’s decision to grant summary judgment on the ground of qualified immunity is reviewed de novo. See Davis v. City of Las Vegas, 478 F.3d 1048, 1053 (9th Cir. 2007); Bingham v. City of Manhattan Beach, 341 F.3d 939, 945 (9th Cir. 2003).[68] The denial of a motion for summary judgment based on qualified immunity is also reviewed de novo. See Rodis v. City and County of San Francisco, 558 F.3d 964, 968 (9th Cir. 2009); KRL v. Estate of Moore, 512 F.3d 1184, 1188 (9th Cir. 2008); Lee v. Gregory, 363 F.3d 931, 932 (9th Cir. 2004); Bingham, 341 F.3d at 945-46 (describing two-step inquiry). Whether federal rights asserted by a plaintiff were clearly established at the time of the alleged violation is a question of law reviewed de novo. See Boyd v. Benton County, 374 F.3d 773, 778 (9th Cir. 2004).[69]

The existence of sovereign immunity is a question of law reviewed de novo. See Allen v. Gold Country Casino, 464 F.3d 1044, 1046 (9th Cir. 2006); Orff v. United States, 358 F.3d 1137, 1142 (9th Cir. 2004).[70] Dismissals based on sovereign immunity are reviewed de novo. See Blaxland v. Commonwealth Dir. of Public Prosecutions, 323 F.3d 1198, 1203 (9th Cir. 2003) (foreign sovereign immunity); Steel v. United States, 813 F.2d 1545, 1548 (9th Cir. 1987).

Whether an Indian tribe possesses sovereign immunity is a question of law reviewed de novo. See Burlington Northern & Santa Fe Ry. Co. v. Vaughn, 509 F.3d 1085, 1091 (9th Cir. 2007); Linneen v. Gila River Indian Cmty, 276 F.3d 489, 492 (9th Cir. 2002). Whether Congress has abrogated an Indian tribe’s sovereign immunity is a question of statutory interpretation also reviewed de novo. See Krystal Energy Co. v. Navajo Nation, 357 F.3d 1055, 1056 (9th Cir. 2004); Demontiney v. United States, 255 F.3d 801, 805 (9th Cir. 2001).

A dismissal based on Noerr-Pennington immunity is reviewed de novo. See Manistee Town Ctr. v. City of Glendale, 227 F.3d 1090, 1092 n.2 (9th Cir. 2000); Oregon Natural Res. Council v. Mohla, 944 F.2d 531, 533 (9th Cir. 1991).

37. Impleader

The district court’s decision to allow a third‑party defendant to be impleaded under Federal Rule of Civil Procedure 14 is reviewed for an abuse of discretion. Brockman v. Merabank, 40 F.3d 1013, 1016 (9th Cir. 1994); Stewart v. American Int’l Oil & Gas Co., 845 F.2d 196, 199 (9th Cir. 1988).

38. In Forma Pauperis Status

The district court’s denial of leave to proceed in forma pauperis is reviewed for an abuse of discretion. Minetti v. Port of Seattle, 152 F.3d 1113, 1115 (9th Cir. 1998); O’Loughlin v. Doe, 920 F.2d 614, 617 (9th Cir. 1990). A court’s decision to impose a partial fee is reviewed for an abuse of discretion. See Taylor v. Delatoore, 281 F.3d 844, 847 (9th Cir. 2002); Olivares v. Marshall, 59 F.3d 109, 111 (9th Cir. 1995); Alexander v. Carson Adult High Sch., 9 F.3d 1448, 1449 (9th Cir. 1993) (noting discretion is not “unbridled”). The denial of a motion for appointment of counsel to an in forma pauperis party is reviewed for an abuse of discretion. See Rand v. Rowland, 113 F.3d 1520, 1525 (9th Cir. 1997), vacated on other grounds, 154 F.3d 952 (9th Cir. 1998) (en banc).

39. Inherent Powers

A district court’s exercise of its inherent powers is reviewed for an abuse of discretion. See Southern California Edison Co. v. Lynch, 307 F.3d 794, 807 (9th Cir. 2002) (case management).[71]

40. Injunctions

A district court’s decision regarding preliminary injunctive relief is subject to limited review. See Harris v. Board of Supervisors, L.A. County, 366 F.3d 754, 760 (9th Cir. 2004) (“limited and deferential”); Southwest Voter Registration Educ. Pro. v. Shelley, 344 F.3d 914, 918 (9th Cir. 2003) (en banc) (same); Prudential Real Estate Affiliates, Inc. v. PPR Realty, Inc., 204 F.3d 867, 874 (9th Cir. 2000). The court should be reversed only if it abused its discretion or based its decision on an erroneous legal standard or on clearly erroneous findings of fact. See FTC v. Enforma Natural Products, 362 F.3d 1204, 1211-12 (9th Cir. 2004); Harris, 366 F.3d at 760.[72]

A preliminary injunction must be supported by findings of fact, reviewed for clear error. See Independent Living Center of S. California, Inc. v. Shewry, 543 F.3d 1050, 1055 (9th Cir. 2008); Hawkins v. Comparet-Cassani, 251 F.3d 1230, 1239 (9th Cir. 2001). The district court’s conclusions of law are reviewed de novo. See Shewry, 543 F.3d at 1055; Brown v. California Dep’t of Transp., 321 F.3d 1217, 1221 (9th Cir. 2003).

Note that review is de novo when the district court’s ruling rests solely on a premise of law and the facts are either established or undisputed. See Harris, 366 F.3d at 760.[73]

The scope of injunctive relief is reviewed for an abuse of discretion or application of erroneous legal principles. See United States v. Schiff, 379 F.3d 621, 625 (9th Cir. 2004); Idaho Watersheds Project v. Hahn, 307 F.3d 815, 823 (9th Cir. 2002); Rolex Watch, U.S.A., Inc. v. Michel Co., 179 F.3d 704, 708 (9th Cir. 1999) (finding the scope of injunctive relief granted was inadequate).

The district court’s refusal to modify or dissolve a preliminary injunction will be reversed only where the district court abused its discretion or based its decision on an erroneous legal standard or on clearly erroneous findings of fact. See ACF Indus. Inc. v. California State Bd. of Equalization, 42 F.3d 1286, 1289 (9th Cir. 1994) (modify); Tracer Research Corp. v. National Envtl. Servs. Co., 42 F.3d 1292, 1294 (9th Cir. 1994) (dissolve).[74] Whether a district court has jurisdiction to vacate a preliminary injunction during the pendency of an appeal is a question of law reviewed de novo. See Prudential Real Estate, 204 F.3d at 880. The court’s decision not to enforce an injunction is reviewed for an abuse of discretion. See Paulson v. City of San Diego, 294 F.3d 1124, 1128 (9th Cir. 2002) (en banc); see also Buono v. Kempthorne, 527 F.3d 758, 773 (9th Cir. 2008) (reviewing order enforcing prior injunction).

A district court’s decision to hold a hearing or to proceed by affidavit is reviewed for an abuse of discretion. See United States v. Peninsula Communications, Inc., 287 F.3d 832, 839 (9th Cir. 2002). The court’s discretion to consolidate the hearing on a request for a preliminary injunction with the trial on the merits is “very broad and will not be overturned on appeal absent a showing of substantial prejudice in the sense that a party was not allowed to present material evidence.” Michenfelder v. Sumner, 860 F.2d 328, 337 (9th Cir. 1988) (internal quotation marks omitted).

The district court’s decision to require a bond is reviewed for an abuse of discretion. See Barahona-Gomez v. Reno, 167 F.3d 1228, 1237 (9th Cir. 1999). The amount of the bond is also reviewed for an abuse of discretion. See Connecticut Gen. Life Ins. Co. v. New Images of Beverly Hills, 321 F.3d 878, 882 (9th Cir. 2003); Barahona-Gomez, 167 F.3d at 1237.

The district court’s decision to grant permanent injunctive relief is reviewed for an abuse of discretion or application of erroneous legal principles. See Fortyune v. American Multi-Cinema, Inc., 364 F.3d 1075, 1079 (9th Cir. 2004) (reviewing summary judgment).[75] The denial of a request for a permanent injunction is also reviewed for an abuse of discretion. See Cummings v. Connell, 316 F.3d 886, 897 (9th Cir.), cert. denied, 539 U.S. 927 (2003).